Increasing volatility in capital markets

The importance of cost-effective risk management for limiting high losses is widely known and extensively documented in academic literature and in practice. The massive stock market declines following the outbreak of the Covid-19 pandemic, the Russian invasion of Ukraine and the return of inflation, resulting in a rise in interest rates, have led to a renewed call for investment strategies with professional risk management and a focus on loss limitation. One way of limiting losses to a pre-defined threshold are so-called portfolio protection strategies. It is well known that there are no investment concepts that limit losses on the one hand and allow full participation in positive market regimes on the other. However, portfolio protection strategies can offer real added value for investors over whole market cycles and for investors who seek to limit potential losses. They enable these investors to participate in the market and invest in assets that could not be considered without protection due to their loss intolerance.

Lessons of history

Predicting negative tail events correctly, and reacting tactically to them in good time, is almost impossible in the medium term. In addition, such loss periods often occur simultaneously in most non-risk-free asset classes, meaning that diversification fails precisely when it is most needed. Limiting the potential loss through risk management is therefore the only effective short-term protection against negative extreme events. Although drawdowns are usually followed by a recovery phase, the temporary loss often exceeds investors’ risk tolerance.

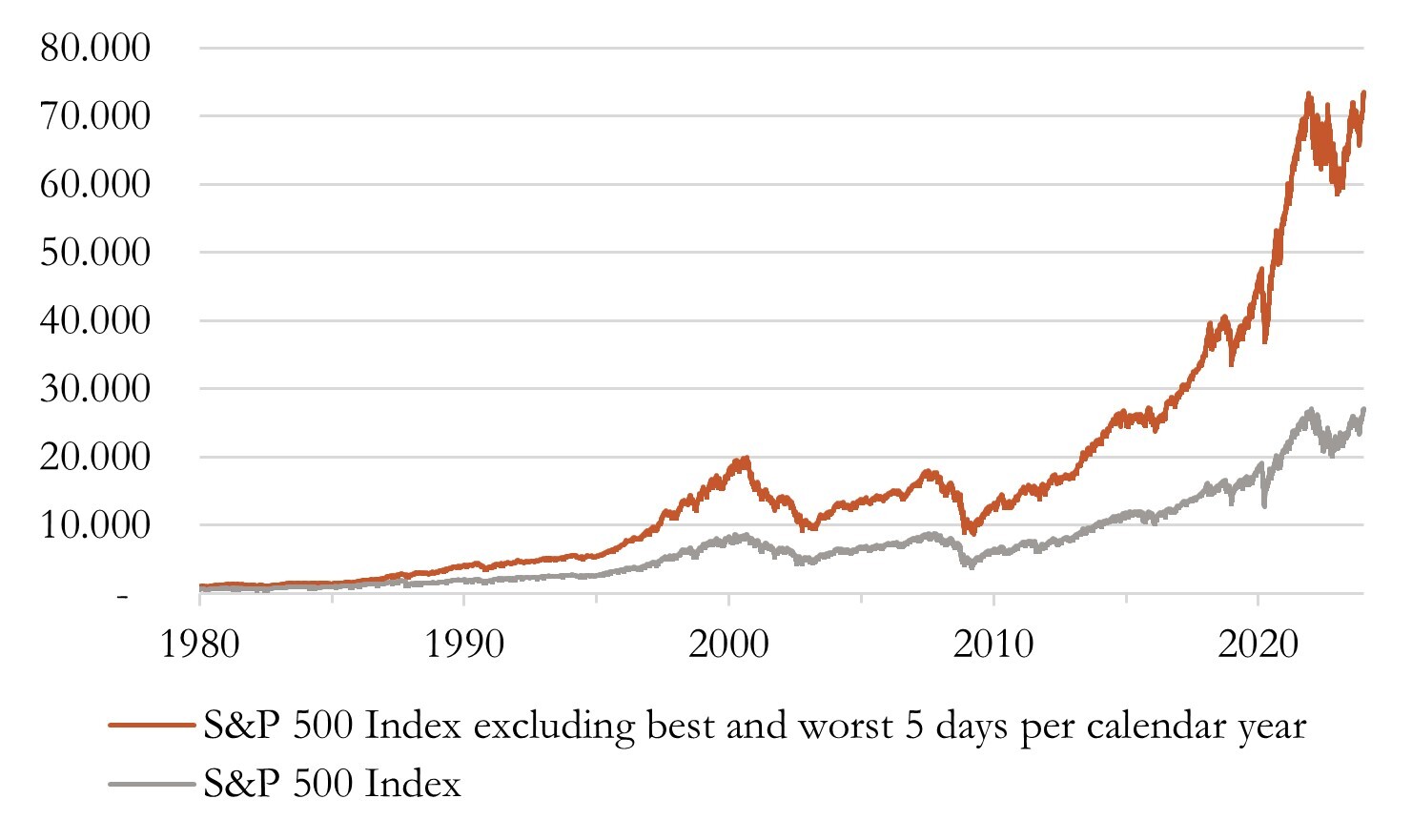

Fig. 1: Extreme market movements can lead to high losses in a short period of time

Even though the historical average return of equity markets has been positive over a long period of time, negative tail events have a significant impact on an investor’s long-term return. This can be illustrated with a simple example: by selectively excluding the best and worst five days of each calendar year, the S&P 500 Index would have risen from an initial 100 points to over 60,000 points since 1928. In contrast, the conventional index would only have reached just under 25,000 points. It can be deduced from this that the return distribution shows far greater losses than extreme gains – the return distribution is not symmetrical. This is precisely where a portfolio protection mechanism offers the advantage of reducing these so-called left tails over market cycles, even if this often results in slightly lower returns in good years compared to a strategy without risk management.

Fig. 2: Extremely negative days are more critical for long-term returns than positive ones

Another factor that has contributed to more extreme movements and thus increased volatility in recent years is the increasing prevalence of passive and rules-based investment approaches. Index funds already control an estimated 20 to 30 percent of the volume on the US equity market. The greater the passive penetration of the market, the higher the volatility of the market as a whole, as the correlation between individual stocks increases and diversification within the index decreases, as buying and selling usually take place simultaneously. Added to this is the dominance of a few large stocks, such as Apple, Nvidia and Alphabet. Due to their high market capitalisation, they often have a high weighting in equity indices, as these are usually weighted according to market capitalisation. This means that the volatility of large equity indices is increasingly influenced by a small number of individual stocks.

Expectations of the investor

Many investors focus on expected returns. This approach makes sense for long-term investment horizons, as the actual average return often approaches the expected value as the investment period increases. However, short-term returns can deviate considerably from the expected return, particularly in the case of riskier and more volatile investments. An investment in equities with an expected long-term return of 7% p.a. can result in short- and medium-term losses of 50% or more.

Even portfolios with a conservative allocation of 30% equities and 70% bonds regularly suffer higher losses. The year 2022 has shown that even pure investment-grade bond portfolios can record double-digit losses.

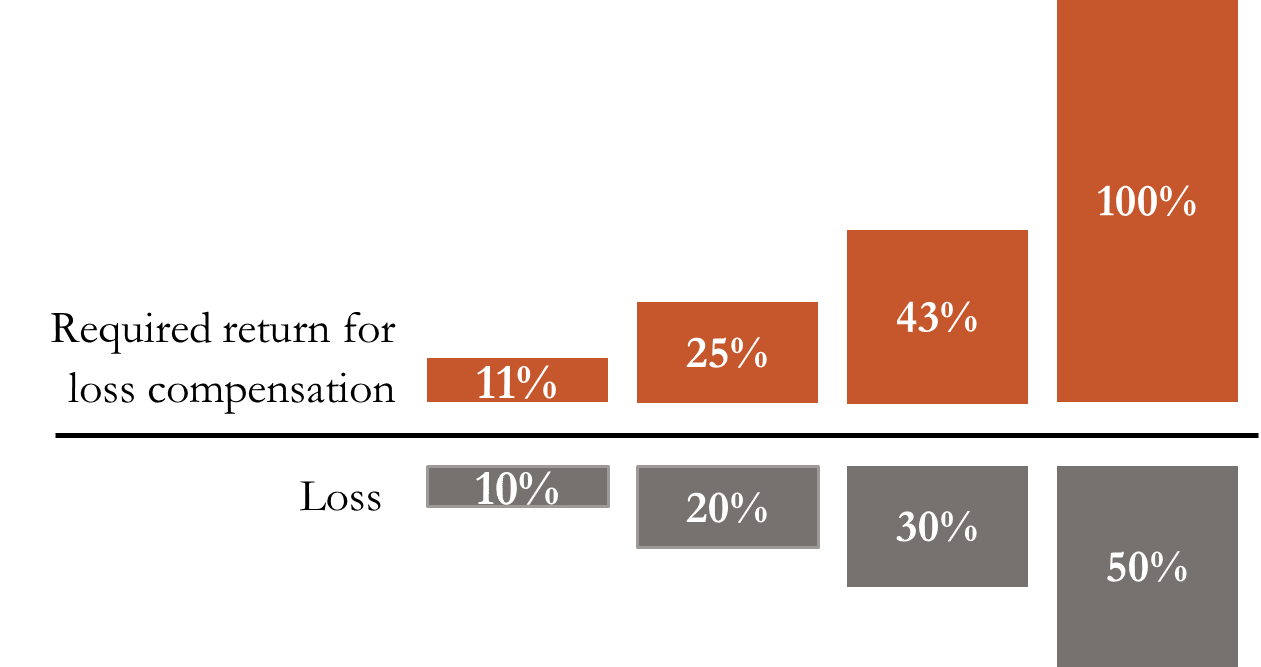

Even in long-term investment horizons, a temporary loss can play a significant role. The timing of the loss can also be crucial for achieving the investment goals. Sharp drops in the value of an equity portfolio shortly before the money is needed – for example, for an investment project or retirement – but also extreme initial losses on large one-off amounts are extremely detrimental. If the invested capital shrinks by 50%, for example, it must be doubled from the new base in order to recover the incurred loss, which can have a significant impact on long-term growth rates.

Fig. 3: Relationship between incurred loss and return required to compensate for it

Institutional investors are also faced with a further dilemma in relation to the investment horizon: on the one hand, they have to achieve long-term investment goals, while on the other hand they often think in terms of calendar years and have to account for short-term performance in regular investment committees. In addition, there are investor groups such as corporates that are required to disclose profits and losses from investments in their annual financial statements. In such cases, a predetermined loss limit can be beneficial, as it is not appreciated when solid operating results are negatively impacted by investment losses, especially when investing is not the core activity of the company.

Portfolio protection with a maximum potential loss

The basic idea of a portfolio protection strategy is to reduce portfolio risk in the event of increasing volatility and increasing losses. The aim is to not fall below a pre-defined loss threshold. If the loss threshold is reached, the portfolio ends up in a so-called cash lock. This is the state in which the portfolio’s exposure is allocated exclusively to risk-free investments, ensuring that the investor does not suffer any further losses but can also no longer benefit from any recoveries.

Professionally managed portfolio protection strategies have mechanisms that aim to prevent cash locks. This is the only way to ensure upside participation in the event of a recovery.

Functionality of portfolio protection strategies with a maximum loss value

Portfolio protection strategies with a maximum loss value can often be broken down into three steps:

- Risk measurement

The first step is to calculate the expected loss of the portfolio over a specified future period in a negative market.

- Risk monitoring

In the second step, the risk-bearing capacity of the portfolio is determined. To do this, the potential loss from step one is compared with the risk that the investor has agreed to take. This makes it possible to assess whether the portfolio would fall below the previously defined loss threshold in a negative risk event.

- Risk reduction

As soon as it is determined that the risk of the portfolio exceeds its capacity, the portfolio risk is reduced by selling or hedging positions. This ensures that the portfolio risk is in line with the acceptable risk and that the portfolio value does not fall below the lower limit.

Portfolio protection strategies of different providers vary in the implementation of the steps listed above – for example, how the risk is measured or monitored, when a risk reduction takes place or how the portfolio risk is reduced and built up again if necessary. However, these differences in the individual steps can lead to large, long-term differences in returns.

Berenberg Protected Multi Asset Strategy (ProMAS)

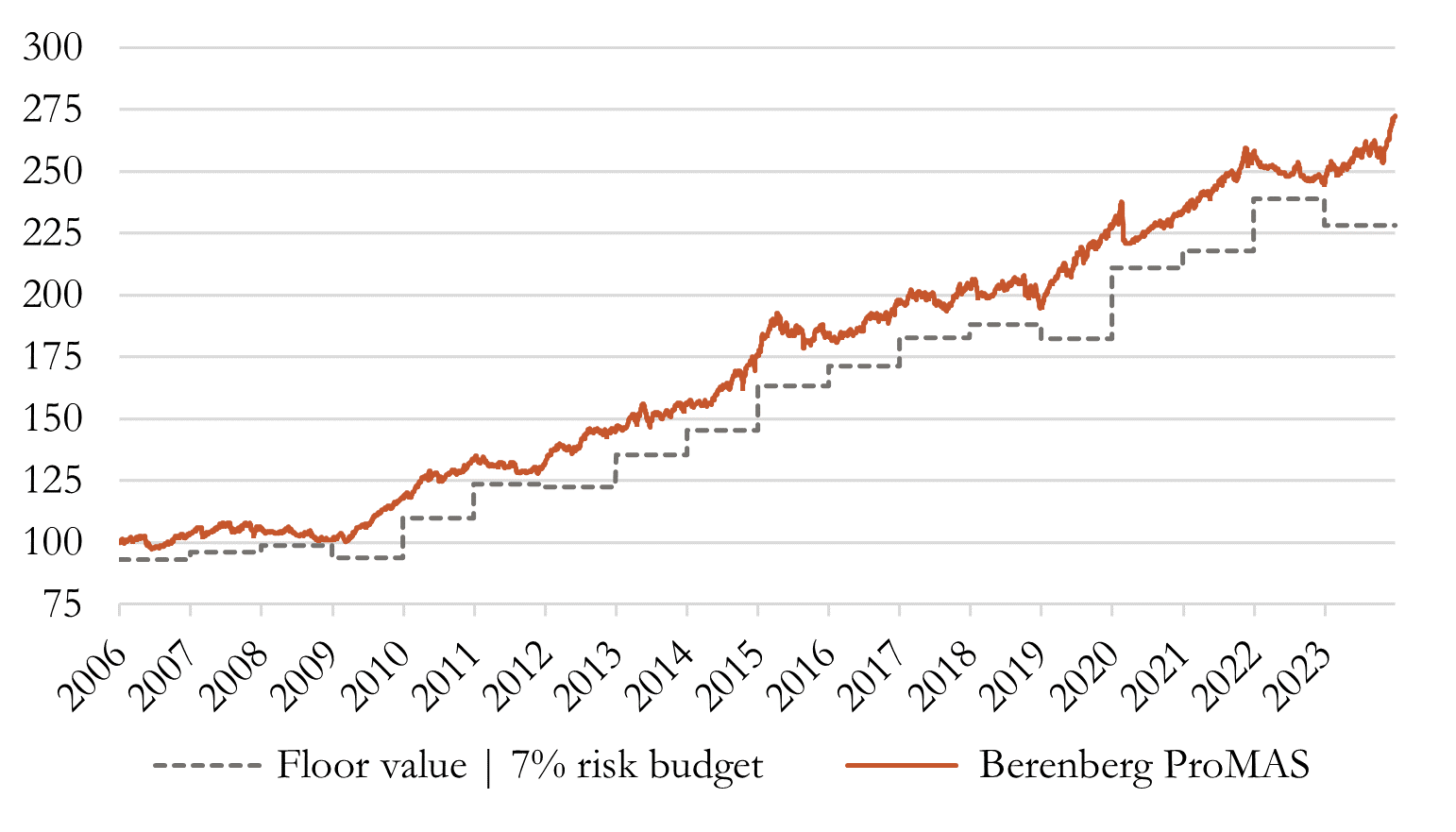

The Berenberg ProMAS portfolio protection strategy focuses on the efficient use of the available risk budget. In addition to cost-effective risk management, the aim of ProMAS is to significantly reduce the probability of cash locks. In contrast to conventional models, the risk budget is used according to a proprietary model, reducing the dependency on a specific release date. This makes it possible to limit losses at an early stage in order to benefit from possible recovery phases due to the remaining risk budget.

The long live track record since 2008 has allowed the strategy to be developed and tested over a long period of time to ensure solid and sustainable performance. The ultimate goal of the mechanism is to allow the investor the highest possible participation in rising capital markets while adhering to pre-defined risk limits. In the medium and longer term, this can only be achieved if cash locks are avoided as much as possible, as otherwise it will not be possible to participate when the market recovers.

The performance of portfolio protection strategies can therefore vary greatly in different market scenarios:

- In rising markets there is little need to intervene, so the performance should be similar to a strategy without protection and hardly differ among providers.

- Volatile and sideways-moving markets are particularly challenging for strategies with a maximum loss value. Here it is important that the strategy manages its investment level efficiently, as otherwise the pro-cyclical adjustments can often lead to small losses without major participation in upward movements. This can quickly lead to a cash lock situation.

- The portfolio protection strategy shows its strength in the event of sharp market declines with a sustained low price level in the absence of a recovery or prices falling even further. It then limits painful losses below a certain lower value limit. However, if there is a recovery after a drawdown, classic portfolio protection strategies can only benefit disproportionately from the upswing – if there is any risk budget left at all. It takes a certain amount of time for rising prices to again release the previously depleted risk budget so that new positions can be built up. In such recoveries, different providers usually vary greatly: those that were able to avoid the cash lock are now benefiting from the upward movement, while those that ended up in a cash lock are watching from the sidelines.

In contrast to conventional portfolio protection approaches, the Berenberg ProMAS strategy benefited from the strong market recovery in 2020 and ended the year with a return of close to zero. The strategy was even able to finish the challenging year 2022 without a cash lock.

Fig. 4: Case studies from existing mandate

Fig. 5: Backtest of a global multi-asset portfolio

with volatility target of 7% and Berenberg’s ProMAS portfolio protection mechanism

Conclusion

Despite an average positive return over a long period, there are regularly falling markets that have a negative impact on the portfolio. Portfolio protection strategies can help to achieve long-term investment objectives and ensure better capital preservation. Active risk management of protection strategies ensures that the portfolio becomes increasingly defensive as a pre-defined floor is approached. This allows losses to be limited in falling markets. At the same time, however, this approach also enables participation in rising markets.

Portfolio protection strategies require well designed and disciplined implementation, as well as an efficient choice of investment instruments, to ensure that the investor’s individual investment objectives and risk tolerance are always met. Berenberg’s ProMAS strategy is also benefitting from the optimised use of the risk budget and the significantly reduced probability of a cash lock.

Authors

Philipp Loehrhoff

Philipp Löhrhoff joined Berenberg in 2021 and is a portfolio manager in the Multi Asset team. In his previous roles he worked closely with institutional investors to structure, develop and place bespoke hedging and investment solutions. He is an expert for quantitative investment strategies as well as cross asset solutions with a particular focus on equity and fixed income. He spent several years at Goldman Sachs, BNP Paribas and Natixis in London. Philipp holds a Master‘s degree in Finance and Economics and a Bachelor’s degree in Econometrics and Mathematical Economics from the London School of Economics and Political Science (LSE).