Striking the right balance between capturing upside potential and limiting downside risk has always been a challenge. Many investors turn to traditional multi-asset portfolios in pursuit of diversification. While this approach provides exposure to asset classes such as commodities and bonds, diversification is not always reliable and not a properly orchestrated reduction of equity risk. The recent environment of heightened inflation volatility has weakened the traditional diversification benefits of bonds within multi-asset portfolios. This underscores the need for alternative risk-mitigation strategies, such as hedging, to protect portfolios while still maintaining meaningful upside participation. Recognising this challenge, we have developed an innovative yet proven investment approach that harnesses the growth potential of equities while mitigating potential losses through options. Our Protected Equities Strategy invests in equities and uses options to reduce downside risks while seeking to achieve attractive returns by capturing equity market upside.

The Importance of Hedging and Common Misconceptions

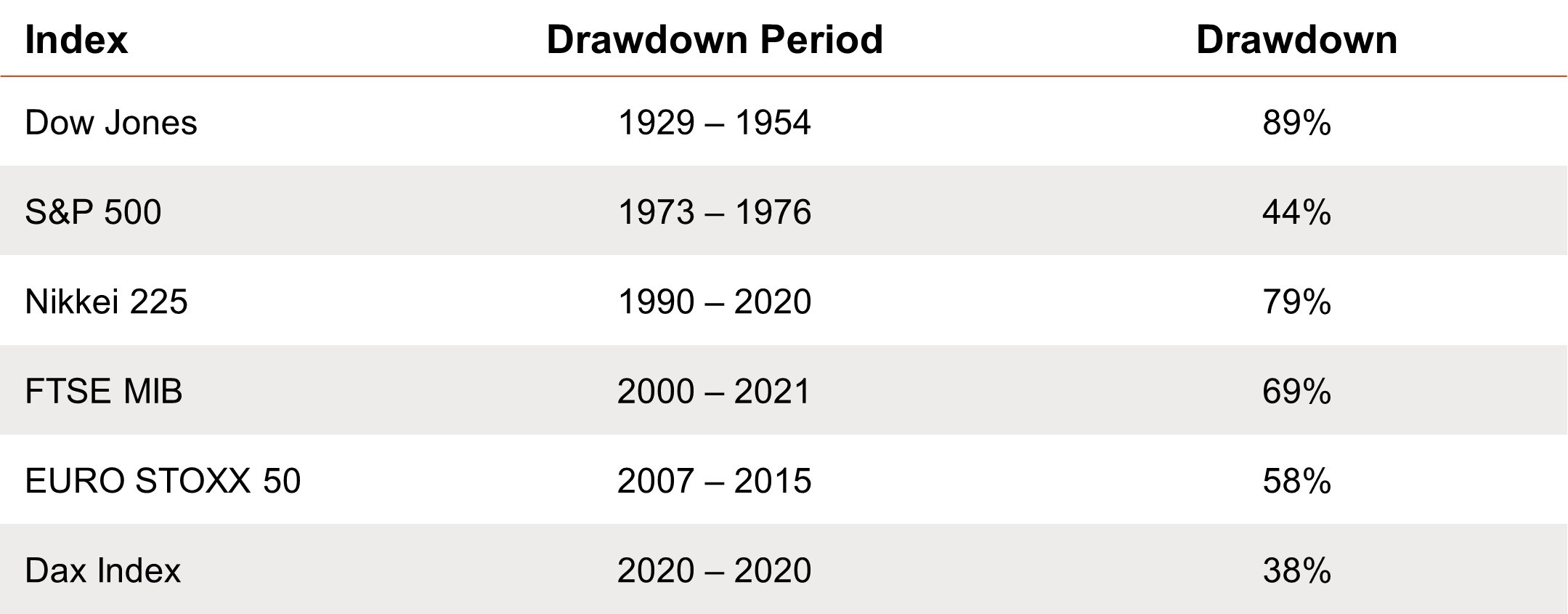

Investing requires navigating periods of high volatility and "tail events" - rare but extreme occurrences that can trigger significant market downturns. Understanding these events and their characteristics is essential for effective risk management. However, anticipating and responding tactically to these events in a timely manner is often unfeasible due to their unpredictable nature. This reinforces the need for an investment strategy like our Protected Equities Strategy.

During extreme market distress, losses tend to occur simultaneously across most risk-bearing assets, as many share the same fundamental return drivers. As a result, traditional diversification can fail when it is needed most, highlighting the importance of effective risk management. Systemic risk, which affects a broad range of securities, cannot be diversified away, making robust risk management one of the few effective defences against severe market sell-offs. Moreover, both the length of recovery periods and the magnitude of losses often exceed the risk tolerance of even long-term investors.

Table 1: Equity markets repeatedly experience long periods of significant losses.

There are three common misconceptions about the risk-return relationship and the compounding of portfolio returns over full market cycles, even among professional investors:

Misconception 1: “Lower Risk Means Lower Return”

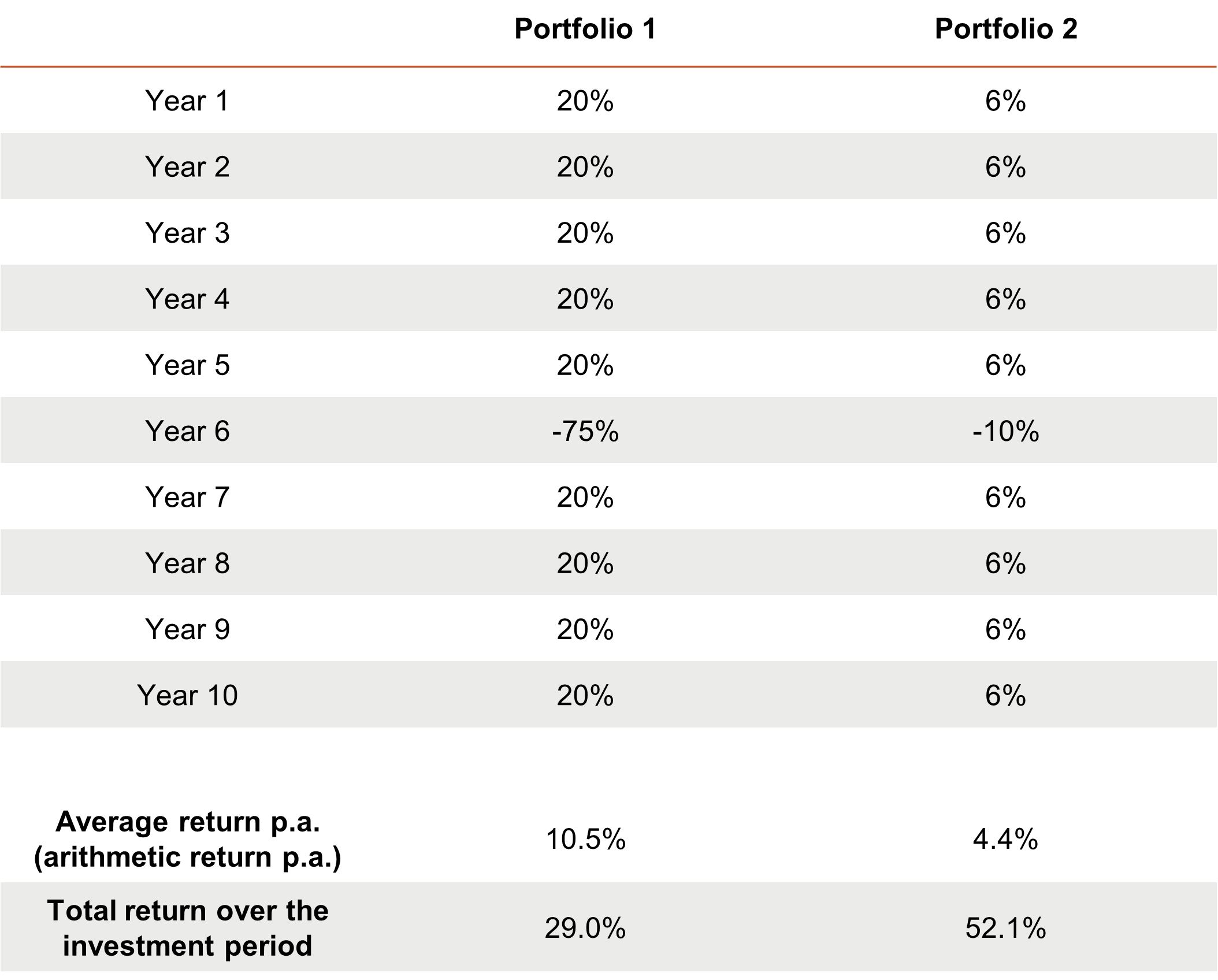

The compounding of returns over time means that a single significant loss or drawdown can dramatically reduce an investor's wealth. The larger the drawdown, the greater its detrimental impact on compounding. For example, a 50% drawdown requires a 100% return to break even. It is not the arithmetic average of returns that matters, but the geometric average, which reflects how returns compound over time. Cost-efficient protection strategies can enhance long-term returns by reducing portfolio risk and preventing large losses. The example below highlights why compounded returns are more important than average returns for wealth accumulation. A single major loss in year 6 - where Portfolio 1 drops 75% while Portfolio 2 declines only 10% - can drastically change the investment outcome. Even though Portfolio 2 experiences much lower returns in strong market years, it ultimately generates greater wealth due to its superior geometric return rate.

Table 2: Higher total return due to loss reduction and limited volatility.

Misconception 2: “In the Long Run, Hedging Costs Money Due to its Negative Expected Value”

The claim that hedging costs money in the long run oversimplifies a complex issue and overlooks several critical factors. Even if we assume, for argument’s sake, that hedging has a negative expected value when viewed in isolation, this view fails to consider its broader impact on the portfolio and investor behaviour.

Firstly, as shown in Table 2, hedging can enhance overall portfolio returns through improved compounding. By incorporating assets with a negative correlation to the core portfolio - even if they generate negative returns individually - the reduction in portfolio volatility and drawdowns can lead to higher geometric returns over time.

To illustrate this, consider a simple two-asset portfolio:

• Portfolio 1 consists entirely of Asset A (100% allocation).

• Portfolio 2 allocates 95% to Asset A and 5% to Asset B, a hedge asset with a negative expected return.

While Portfolio 2 may experience lower returns in positive years, it benefits from reduced losses in downturns. As a result Portfolio 2 achieves higher total and annualised returns over the full investment period. This example clearly demonstrates that adding a hedge - even one with a negative expected return - can significantly improve investment outcomes. Therefore, the notion that hedging is unnecessary simply because it has a negative expected value is fundamentally flawed.

Table 3: Adding hedge assets to an investment portfolio can enhance overall returns, even after accounting for hedging costs

Secondly, the downside protection from the hedge allows for higher equity allocations, which can boost long-term returns. Even if hedging incurs costs, maintaining a larger equity allocation allows for greater participation in rising markets, ultimately enhancing overall returns.

Thirdly, options-based hedging strategies can provide significant opportunistic benefits during market crises. As asset prices decline, these hedges generate cash that can be strategically deployed to purchase undervalued assets - potentially leading to outsized returns when the market recovers.

Finally, a common argument against hedging is that it is consistently overpriced, ignoring potential market inefficiencies, which will be discussed later. Skilled investors can identify mispriced hedging instruments, turning perceived "costs" into profitable opportunities. While many hedges may seem expensive in isolation, their true value lies in how they reshape portfolio dynamics and influence investor behaviour.

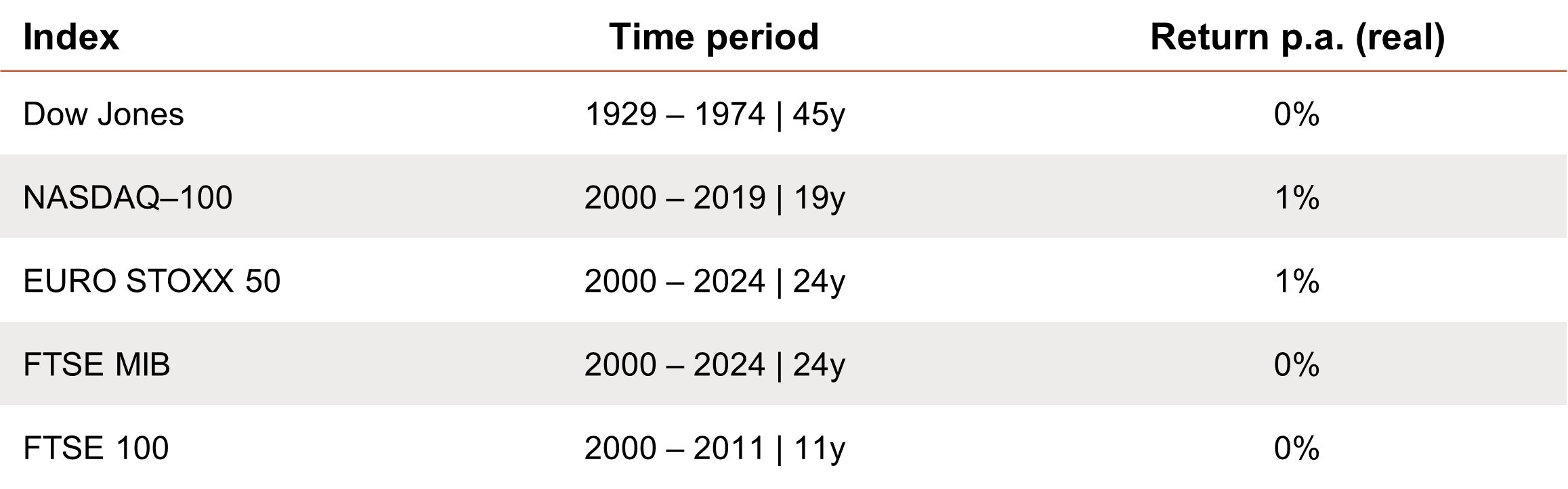

Misconception 3: “Long-Term Investors Can Simply Ride Out Equity Volatility Since Markets Trend Upward Over Time”.

The primary goal of hedging is to enhance long-term returns - either by improved compounding through loss reduction or enabling more aggressive portfolios with lower downside risk. The larger the drawdown, the greater its disproportionate negative impact on portfolio growth, even over extended periods.

While stock markets have historically trended upward over the long run, they have also endured prolonged periods of poor returns. Even with a long investment horizon, experiencing one of these downturns can significantly hinder wealth accumulation. Simply "riding it out" may prevent outright losses, but it can still lead to subpar returns - and over time, that can make all the difference.

The examples in the table below, while extreme, demonstrate that equities can deliver poor returns even over extended periods. This challenges the widespread belief that equities are always a good investment in the long run.

Table 4: Periods of significant losses can result in low real returns over extended periods.

The psychological aspect of investing is also a necessary consideration. Many investors sell during drawdowns, not because they believe it’s the right time to sell, but because they fear further losses or feel external pressure. By mitigating losses, hedging can help investors stay the course through turbulent periods, avoiding costly, emotionally driven mistakes. It's easy to claim you won’t sell in the next drawdown when you're not currently in one and can think rationally, but that mindset can change quickly in periods of distress. Additionally, circumstances change, and investors may not remain as long-term focused as they initially intended.

The Market Cycle and Cost of Hedging

Tail events, or large losses in financial markets, usually stem from significant shifts in aggregate investor sentiment. Understanding these dynamics can provide a strategic advantage in navigating volatile markets. Large losses typically arise from a negative shift in sentiment leading to a rapid repricing of securities with a more pessimistic outlook.

Historically, the more positive the sentiment, the greater the risk of a sharp negative reversal, potentially leading to large losses. When sentiment is overly positive, asset prices tend to be inflated, and negative news or an unexpected event can trigger a sharp shift in sentiment and a repricing of expectations, leading to potentially larger losses compared to periods where the outlook is already negative, and prices are less inflated.

The cost of hedging depends on and fluctuates with market sentiment. Like any other security, the price of hedging is directly linked to its demand: when demand is high, prices rise, and vice versa. However, the timing of this demand often runs inversely to when hedging is most needed, creating a unique cyclical pattern.

During periods of negative sentiment, hedging costs tend to be higher, reflecting heightened perceived risk and increased demand. Fear during these periods can drive an exponential demand for hedging, causing prices to surge. Ironically, this surge in demand often comes after substantial losses have already occurred, when the likelihood of further significant declines diminishes. As a result, investors often end up overpaying for protection when the risk of further losses is low.

Conversely, during periods of positive sentiment, hedging costs are generally lower. With fewer investors seeking protection, demand for hedges declines. As a market rally continues, complacency sets in. Investors forget the painful losses of the past, chase returns, and overlook emerging risks. This tends to occur when sentiment is strongest - just as the risk of losses rises - creating an opportunity to purchase hedges at lower prices when they are most needed.

Long-term investors can capitalise on this cyclical mispricing to gain a strategic edge across market cycles. These market dynamics highlight the importance of maintaining a well-designed hedging strategy across market cycles, even if it may result in slightly lower portfolio returns during positive years.

Protected Equities Strategy

Our Protected Equities Strategy is designed to capitalise on the long term upward trajectory of equity markets by investing in equities while using options to hedge downside risks. What sets our strategy apart is its well-designed risk management framework. By incorporating options, the strategy adds a layer of protection, effectively reducing the risk of significant losses. This combination of upside participation and downside protection allows investors to grow their investments while aiming to reduce losses in adverse market conditions.

During the live track record period, there have been no major drawdown events. The results below demonstrate how the strategy has successfully captured most of the market upside during a strong equity market rally while maintaining downside protection at all times.

Chart 1: Berenberg Protected Equities live track record since inception.

The Protected Equities Strategy offers several compelling benefits. These can be broadly categorised into four areas: reducing losses while aiming for upside participation, enhancing long-term returns, enhancing diversification, and improving the predictability of returns.

Loss Reduction and Upside Participation

The strategy's ability to limit losses is particularly beneficial for long-term investors and those with specific risk tolerance levels. By mitigating significant drawdown risks, the strategy allows investors to increase equity exposure without drastically altering the portfolio’s overall risk profile. Furthermore, during periods of market distress, profits from the options can serve as a source of liquidity for equity investors to purchase stocks at lower prices. In our “tail risk protection” version, we aim to limit annual drawdowns to around 20%.

At the same time, the strategy provides a high level of upside participation, allowing investors to achieve attractive returns in rising markets. For the tail risk protection version, we aim to capture around 90% of positive equity market performance in bull markets.

Enhancing Long-Term Returns

Investment outcomes over full market cycles are the result of how much is gained in good years multiplied by how much is lost in bad ones. A strategy that captures a high degree of upside in positive years while significantly limiting losses during market downturns has the potential to outperform a purely equity-based approach over time. This can lead to higher returns - not because of taking on more risk, but by reducing it. Our strategy seeks to achieve this by cost-effectively hedging against tail risks, thereby enhancing long-term compounded growth potential.

Improved Predictability of Returns

Historically, protected equities have demonstrated greater return predictability compared to pure equity investments. This is achieved through the strategy’s hedging component, which not only reduces losses but also narrows the distribution of returns. By keeping returns close to their long-term average, the strategy reduces the likelihood of extreme deviations resulting in a more consistent performance over time.

Improved Diversification

Investors often diversify across multiple asset classes in the hope that correlations will prove favourable during drawdowns. However, asset correlations during drawdowns usually depend on the underlying cause of the market downturn. In severe market downturns, widespread sell-offs in risky assets often drive correlations higher across securities and asset classes, diminishing the benefits of diversification precisely when they are needed most. Instead of solely relying on diversification among different assets, our strategy uses options to limit downside risks, providing a safeguard against losses through the put option overlay. This ensures favourable diversification benefits and lower correlations during periods of market distress, precisely when diversification is most valuable.

Conclusion

Protected equities can add value for long-term equity investors who focus on full market cycles, as well as for investors with lower risk tolerances who might otherwise not be able to allocate as much to equities. The strategy aims for attractive upside participation in rising markets, while also offering substantial loss reduction during drawdowns. Our strategy can cater for different levels of protection, making it suitable to a wide range of investors with varying risk tolerance profiles.