On March 4 2025, Friedrich Merz proved that it is not just Donald Trump who can influence the financial markets by announcing proposals for significant debt-financed infrastructure and defence spending. This has heralded a new era for financial markets and was followed by a rise in yields at a speed last seen over 30 years ago. Within a week, the yield on the 10-year German government bond rose by 40 basis points (bp), from 2.5% to 2.9%. The term premium – ie the difference between 2-year and 10-year Bunds – also widened significantly. The CDU/CSU and SPD appear to be in agreement on the fiscal expansion, and – while the Greens have yet to support the proposed reforms – we assume that these or similar measures will be adopted.

Fiscal spending drives government yields

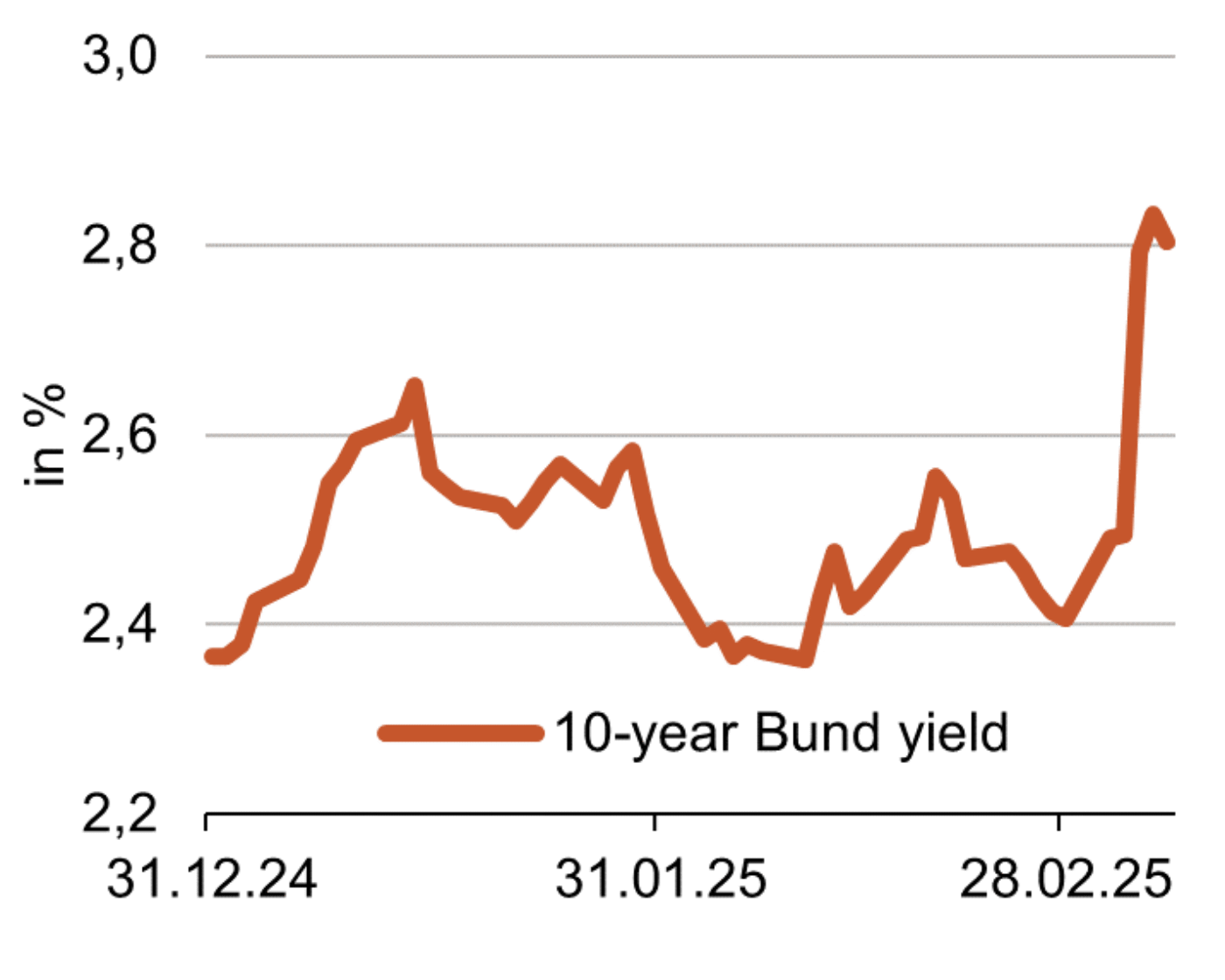

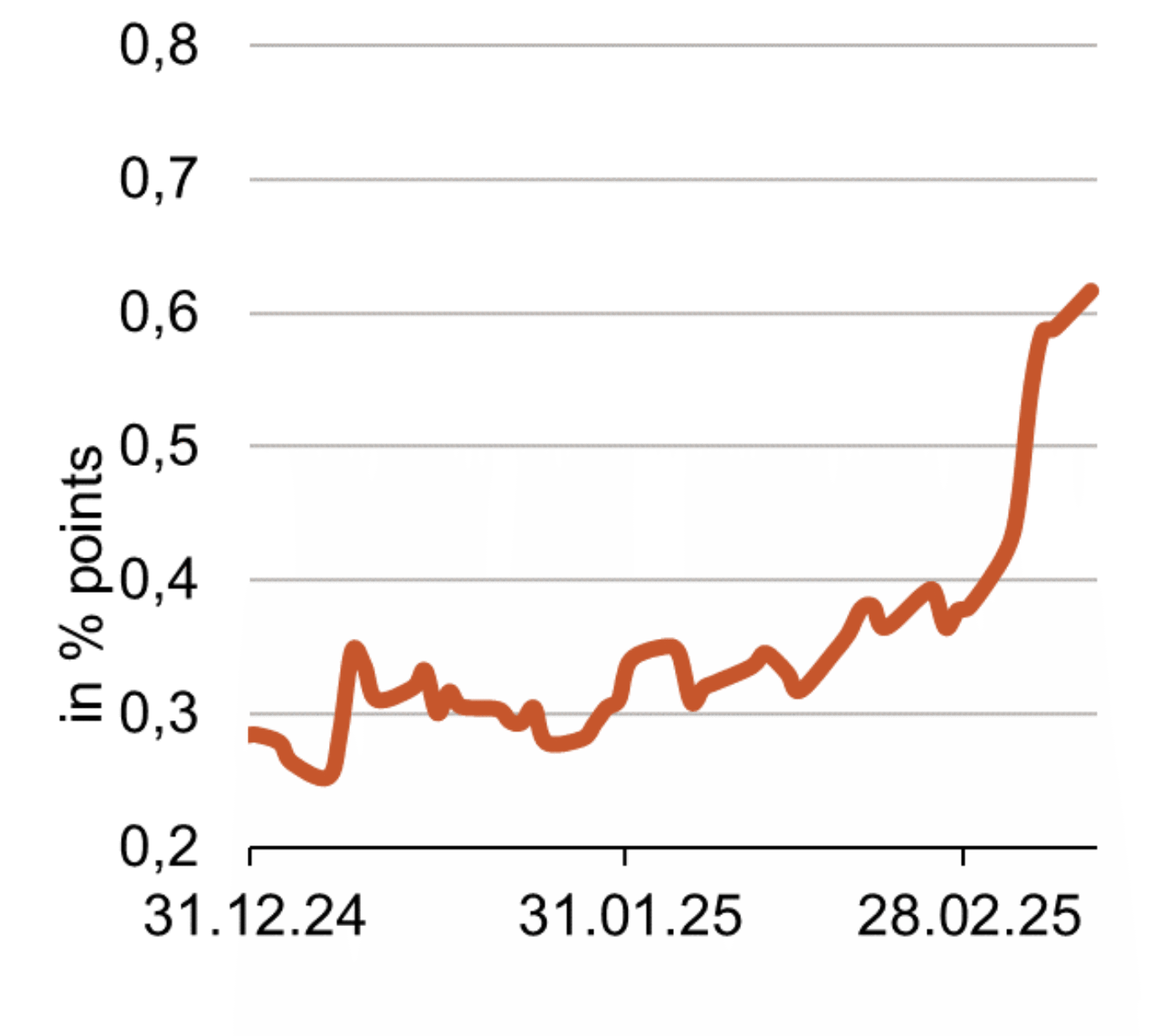

In the past, expected increases in fiscal spending led to distortions in Bund yields. One example of this was in February 1990, when the financial burdens of German reunification became increasingly apparent. Within two weeks, yields on 10-year German government bonds rose by almost 100bp. Currently, yields have risen by around 40bp (Fig. 1). The interest rate differential between 2-year and 10-year German government bonds also widened noticeably (+15bp) (Fig. 2). Yields on longer maturities in particular have risen, as more growth (through investment), higher inflation and increased debt are expected in the medium term.

Fig. 1: Increase in 10-year Bund yield

Fig. 2: Steepness of the yield curve is increasing rapidly

The infrastructure package¹ is expected to amount to €500bn over the next 10 years, defence spending in excess of 1% of GDP is to be disregarded in the calculation of the debt brake and the federal states are also to be given deficit leeway within the debt brake. Votes on the package are to take place on 18 and 21 March. This, at least, is the proposal of the CDU and SPD, and further concessions may even be necessary for its adoption. Taken together, this could mean more than €1trn in additional debt².

As it has become increasingly clear in recent weeks that the US wants to spend less on defence, the European Commission has also put forward the “ReArm Europe” proposal. This five-point plan aims to activate €800bn for defence at EU level over the next four years. In addition, defence spending at country level would no longer be taken into account in EU deficit procedures.

Large spending, unclear effect – markets remain volatile

The sums involved are considerable, but it remains questionable how quickly the capital made available will actually be deployed in a productive way. At its last meeting on 6 March 2025, the European Central Bank (ECB) reiterated that it would rely on facts in its decision making, and would not see any need to take action until specific measures and their details were known. The new measures open up a field of tension between the positive effects of increased government spending (higher potential growth in the medium term, job creation and the revitalisation of infrastructure) and the negative effects, such as the inefficient use of capital and possibly increased inflation.

Various time horizons must be considered when assessing the effects of the fiscal package on pension market developments. In the short term, the capital markets have already priced in a jump in yields. Our economists have also revised their forecasts for the 10-year Bund yield upwards and now see it at 2.8% by the end of the year. In the medium to long term, the effects outlined above should ensure higher growth and, in the long term, rising inflation. This could mean that higher Bund yields and a steeper yield curve are also justified in the longer term. At present, however, Bund yields are caught between increasing geopolitical tensions, potential negative short-term economic developments and growing economic optimism due to the expected fiscal measures. Volatility should, therefore, remain high in the coming months. However, there is a residual risk that the package of measures will not receive sufficient approval. We categorise this as low. In this case, yields on German government bonds can be expected to return to previous levels, as a significant increase in new borrowing would then not be expected.

Corporate risk premiums have not yet shown any reaction to the higher interest rates. On the contrary, European high-yield bonds – in particular – have seen a decline in risk premiums in recent days. This is also justified as companies should benefit from the higher potential growth in the long term. It remains unclear whether risk premiums can remain resilient in the short term, even if interest rates continue to rise. In the past, however, increased realised interest rate volatility has often led to a widening of risk premiums.

Authors