Current market commentary

While European equities recently moved sideways in a volatile manner, US equities fell and approached the 200-day line. Continued robust economic data and a strong US labour market data led to a significant rise in interest rates. US 10-year government bond yields are back around 3.9%, the highest level since November 2022, and the market is now pricing in three more rate hikes this year for the Fed and five for the ECB. With equities outperforming commodities and bonds since the beginning of the year, we have leveraged this into a rebalancing, reducing highly valued US equities in favour of short-dated EUR bonds – also against the backdrop that the major equity indices are no longer far from our year-end forecasts. We are thus slightly underweight equities again for the first time since September 2022. We expect more volatility in the course of the year, thanks to even tighter central banks, declining liquidity and geopolitical risks.

Short-term outlook

From 5 March, the 14th National People's Congress will convene in China. On 7 March, Fed President Jerome Powell addresses the US House and Senate. Coming central bank meetings are taking place from mid-March on. Today, US Durable Goods Orders (Jan) and Eurozone Economic Confidence (Feb) will be released. Preliminary inflation figures (Feb) for France will follow on Tuesday and for Germany on Wednesday. US Consumer Confidence (Feb) and the Chicago Purchasing Managers’ Index (PMI, Feb) will also be released on Tuesday. The industrial PMIs (Feb) for China (including services), the US and the eurozone as well as German retail sales (Jan) will be published on Wednesday. The services PMIs (Feb) for the eurozone and US, German exports (Jan) and French industrial production data (Jan) will be published on Friday. The US labour market data (Feb), on the other hand, will not be published until the following Friday.

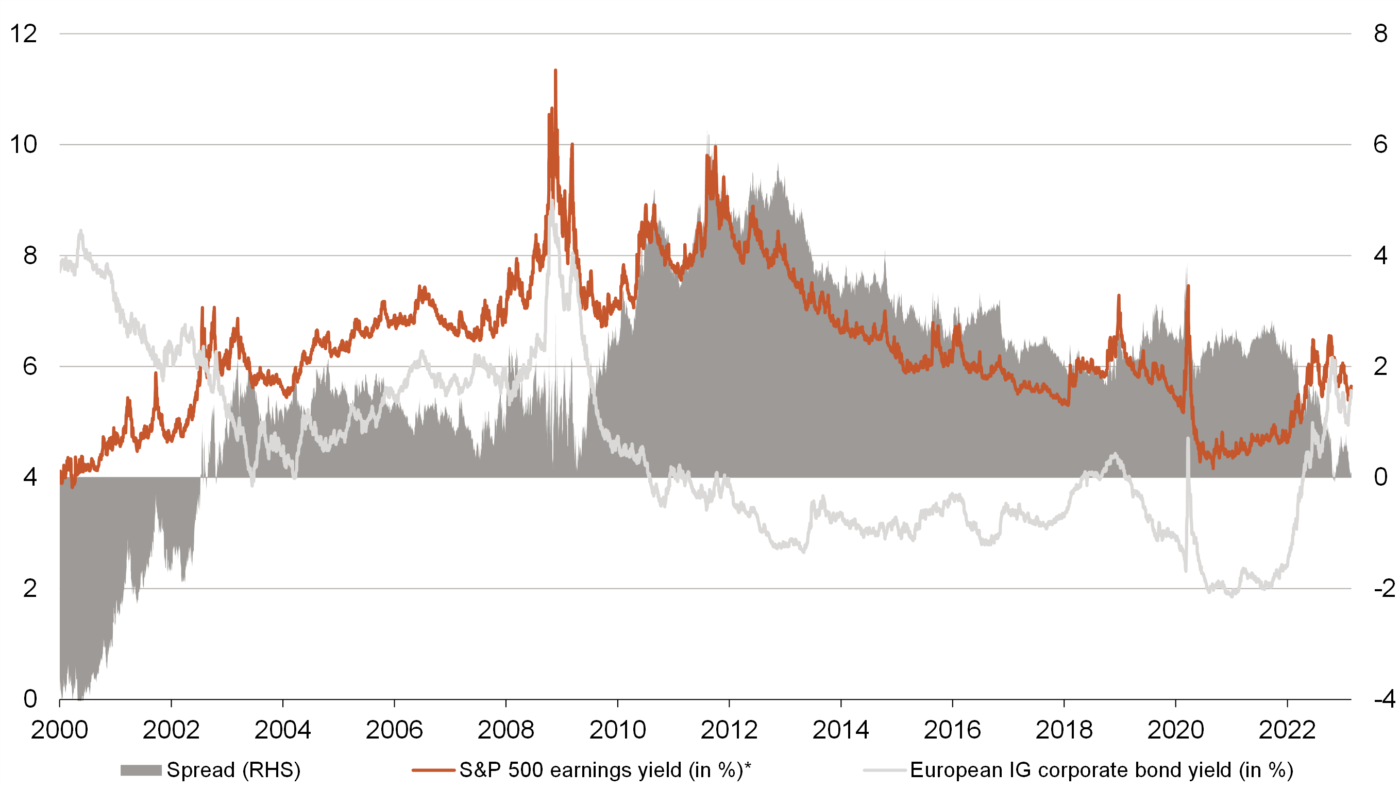

US equities no longer offer a yield advantage over EUR bonds

- With falling earnings estimates and simultaneously rising share prices, the earnings yields of American companies have fallen in recent months. Yields on European corporate bonds with good credit ratings, on the other hand, remain high.

- Thus, unlike in the last 20 years, US equities no longer offer a yield advantage despite higher volatility. In addition, they carry currency risks. With the stronger US dollar, European corporate bonds currently seem more attractive to us.