Current market commentary

Last week's ECB meeting provided little new impetus. The ECB Governing Council maintained its assessment that a discussion about interest rate cuts was premature. As a result, 10-year German government bonds are still trading around 30 basis points higher than at the start of the year. While the consensus on most markets continues to price in a "soft landing" scenario, the probability of a "higher for longer" scenario has at least increased due to the robust US labor market. In addition, the oil price increased by more than 6% since the beginning of the year, which is partly due to the geopolitical conflicts and the cold January. The priced-in US inflation expectations have recently risen again more significantly. Accordingly, the market is eagerly awaiting the Fed's reaction to the latest, largely better-than-expected economic data and the US Treasury's calendar of new issues this week. The Fed meeting is likely to have a stronger impact on the markets than the ECB.

Short-term outlook

The Q4 reporting season is in full swing – of the S&P 500 companies that have reported so far (approx. 25%), almost 80% have exceeded earnings expectations. Following last week's ECB meeting, things will get exciting at the (monetary) policy level on January 31 with the US Federal Reserve's interest rate decision and on February 1 with the Bank of England's interest rate decision. The Chinese New Year also takes place on February 10. The preliminary GDP figures (Q4) for Germany and the eurozone are due tomorrow. European and US (Conference Board) economic confidence (Jan.) will also be published. On Wednesday, the Chinese and US Chicago PMIs (Jan.), the German unemployment rate (Jan.) and preliminary consumer price inflation (Jan.) will follow. Next Thursday the Eurozone PMIs (Jan.) and the US ISM index (Jan.) are due, and on Friday the US unemployment rate (Jan.) and US non-farm employment data (Jan.).

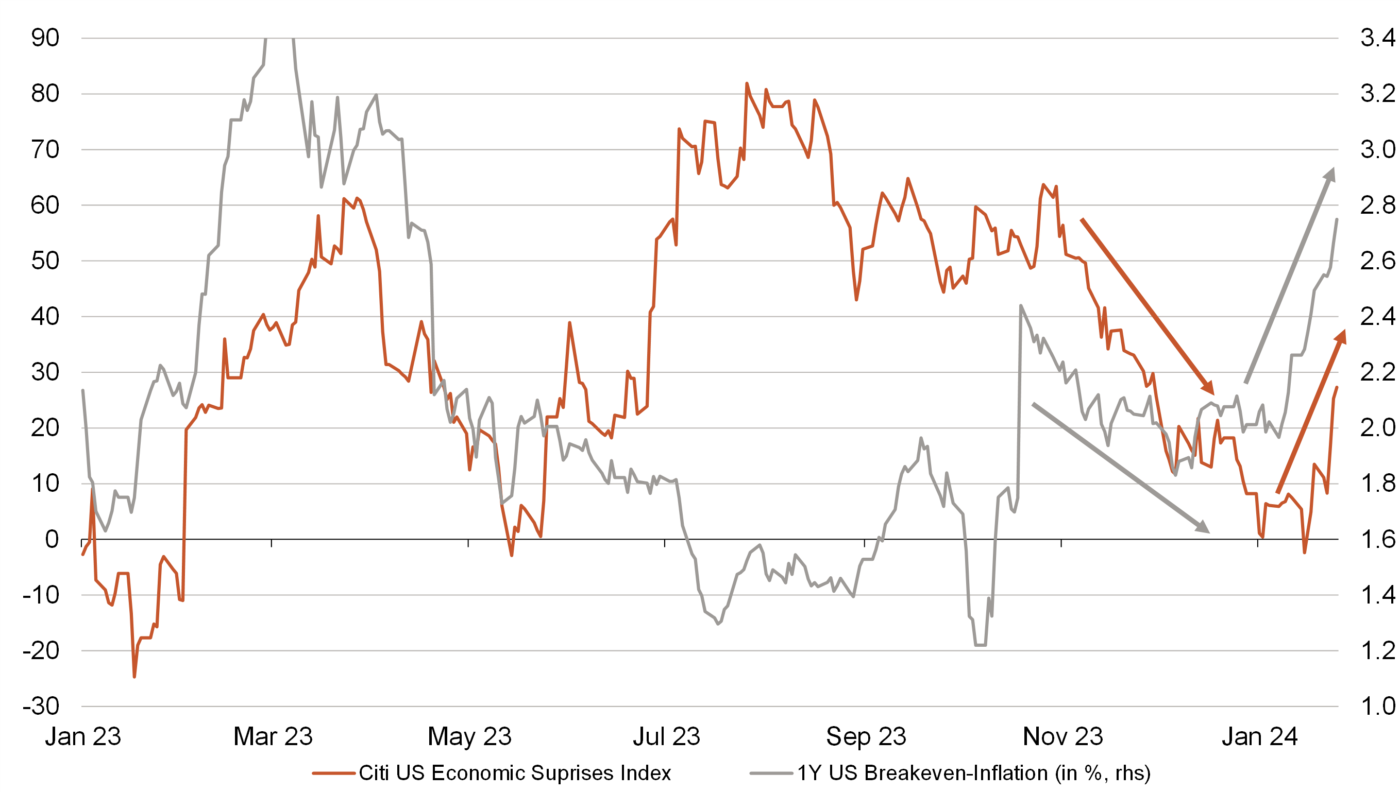

US economy surprises positively. Inflation more persistent after all?

- After hopes of a "soft landing" continued to grow in the previous months with cooler economic and inflation data, recently there have been increasing signs that price pressure could remain more persistent after all.

- Lately, the economy has been surprisingly robust, wage pressure among companies remains high and energy and freight costs are rising again.

- Accordingly, the market has revised its inflation expectations for the next 12 months significantly upwards from below 2% to currently above 2,7%.