Current market commentary

August began with a mini shocker. In addition to S&P, the rating agency Fitch downgraded the long-term credit rating of the US to AA+. The reason for this was the rising budget deficit, the growing national debt and the constant stalemate in the political leadership on fiscal and debt issues. The capital markets reacted to the news with increased volatility, falling equities and rising bond yields. Only energy commodities continued their rally undisturbed thanks to fundamental scarcity. Meanwhile, US inflation data for July came in as expected and failed to provide any new impetus. Investors therefore expect a pause in interest rates for the Fed's September meeting. The first rate cut is being priced in for Q1 next year. With negative base effects coming to an end and commodity prices rising again, inflation is likely to find it increasingly difficult to fall further, which increases the likelihood of high central bank interest rates for longer.

Short-term outlook

The Q2 reporting season is drawing to a close – almost 90% of companies in the US and Europe have already reported. After the two major central bank meetings, the next few weeks will be a little quieter in terms of monetary policy. On Tuesday, ZEW expectations for German economic growth (Aug.), retail sales (Jul.) for the US and China, Chinese industrial production (Jul.) and the Empire State Index (Aug.) will be released. Wednesday will see Eurozone GDP (Q2) and unemployment (Q2) data, as well as US (Jul.) and Eurozone (Jun.) industrial production. On Thursday, the Philadelphia Fed Index (Aug.) and Friday consumer prices (Jul.) of the Eurozone will be published. In the following week, the producer price index (Jul.) and the IFO business climate index (Aug.) for Germany will be published, as well as the preliminary purchasing managers' indices (Aug.) for Germany, France, the UK and the US.

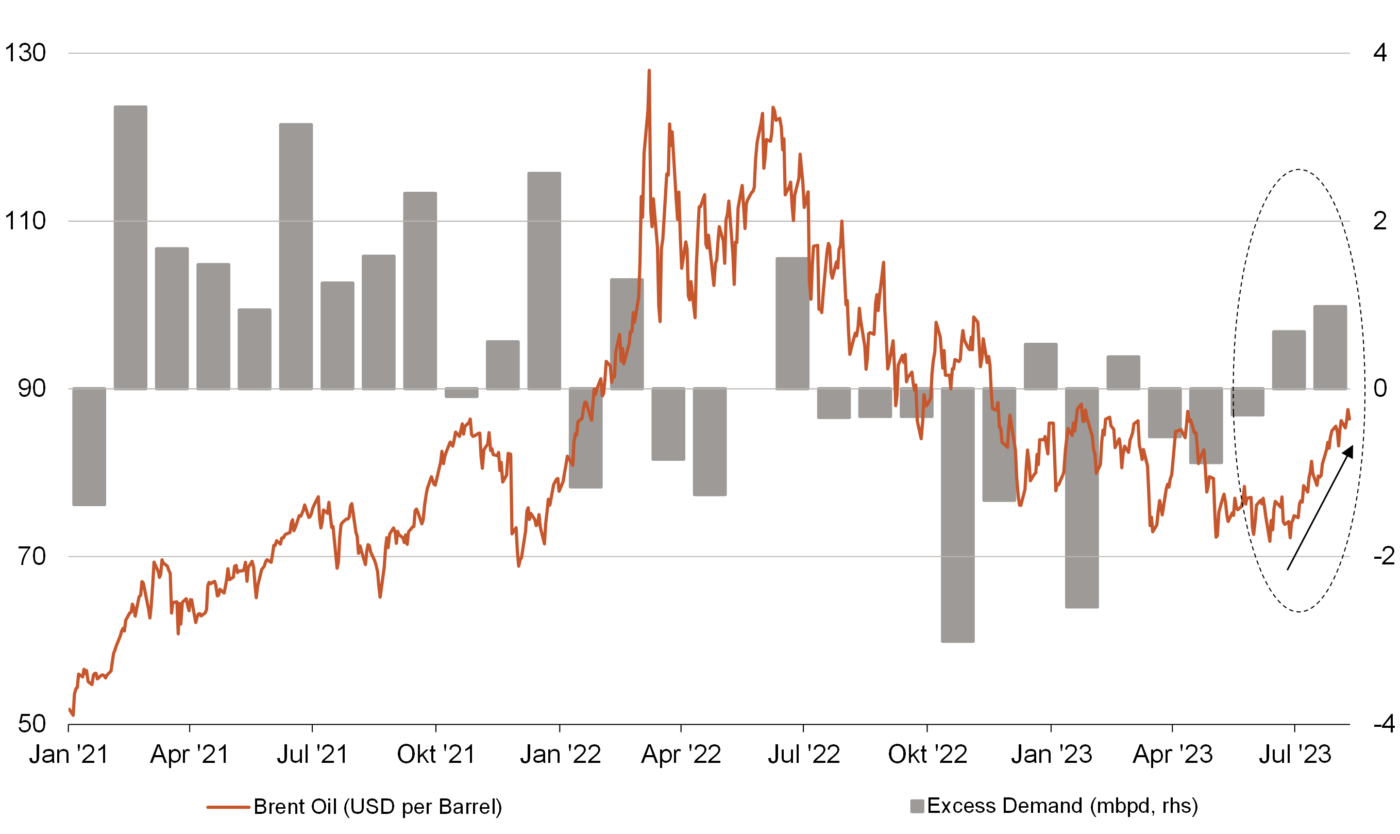

More demand than supply – scarcity boosts crude oil price

- Crude oil put an end to the bumpy start to the year with increased signs of excess demand. The supply-demand structure is doubly tight: on the production side, OPEC is continuing its voluntary cuts; on the demand side, the driving and air-conditioning seasons in the West and higher imports in China are providng support.

- With a performance of more than 15% since the beginning of the third quarter, brent oil was a good counterbalance to equities and government bonds, which were once again under pressure.