Current market commentary

The first two weeks of July are seasonally the two best weeks of the calendar year for US equities - at least that's what the statistics show since 1950. And the seasonality has been confirmed again this year. Despite disappointing US economic data, the S&P 500 has risen every day so far in July except one. Equity funds saw their twelfth consecutive week of inflows, the longest streak since December 2021. Higher earners are benefiting from higher wages and interest income, and some of these savings are being ploughed back into equity markets. When might this income-led support end? Probably if unemployment rises rapidly and sharply, because then investor and consumer sentiment is likely to deteriorate. At that point, the support for US equities from pension funds is also likely to fade. But we are not there yet. The next test for investors will be the Q2 reporting season. The bar for positive surprises is set quite high.

Short-term outlook

The Q2 reporting season is heating up. Nearly 40% of the S&P 500 by market capitalisation will report in the next two weeks. But it's not just the corporate world that will be in focus. The ECB and the Fed are expected to announce their future interest rate policies at their meetings on 18 and 31 July. On the political front, the Eurogroup meeting is on the agenda for today and the Republican National Convention in the US will run until the 18th of July. The Olympic Games in Paris begin on 26 July. Today's agenda includes Q2 GDP, June Industrial Production and June Retail Sales from China, and the July Empire State Index from the US. Tomorrow will see the release of the US Retail Sales (June) and the German ZEW Economic Sentiment (July). On Wednesday we have Euro-Zone June CPI and US July Housing Starts, while on Thursday we have Philadelphia Fed July PMI. The following week, we will see the US Purchasing Managers' Index (July) and US PCE Price Index (June).

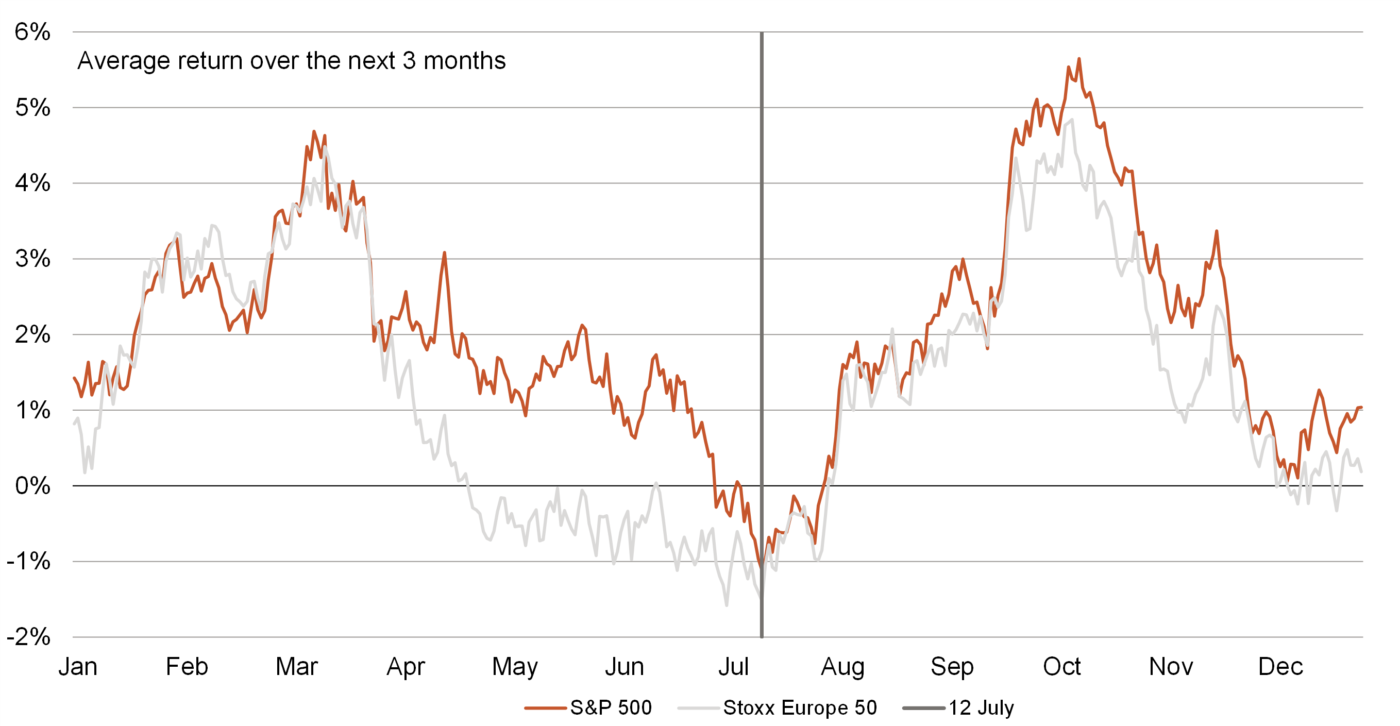

The next three months are seasonally the most difficult for equities

- After a spectacular first half of the year, markets may now be facing a more difficult period. At least that is what seasonality suggests. Before the year-end rally begins in the autumn, equity markets are typically at their weakest in the summer.

- But there are also good fundamental reasons to take a breather. Valuations have risen and earnings expectations are ambitious. At the same time, economic data has been disappointing, and the political disruption caused by the US elections is likely to have an increasingly negative impact.