Current market commentary

July is a month for the history books. Since Reagan (1981), Trump is the first (former) president to be shot. Biden, on the other hand, is the first sitting president since Johnson (1968) to drop out of the race early. The markets were no less excited. The S&P 500 hit a new all-time high almost every day in early July, led by Big Tech. However, the weaker than expected CPI print led to a rotation. The Russell 2000 posted its biggest ever five-day outperformance versus the S&P. More recently, the S&P lost more than 2 % for the first time in more than 356 trading days as the AI euphoria was followed by disillusionment in the reporting season. Given the high level of investor positioning, the typical increase in volatility as the US election campaign progresses and weaker global economic data, a slightly below neutral equity allocation with broad diversification and defensive elements in the selection seems advisable.

Short-term outlook

The Q2 reporting season is in full swing. 199 companies in the S&P 500 (40 %) have already reported their quarterly results. Of these, 69 % have so far beaten market expectations by a median of 6 %. Apart from yesterday's presidential elections in Venezuela and possible renewed unrest around the US elections, the rest of July is likely to be politically quieter. On the monetary policy front, the market will focus on the Federal Reserve meeting on 31 July. German Q2 GDP and preliminary inflation data (July) are on the agenda today, followed tomorrow by US ADP Employment Change (July) and German Unemployment Claims (July). On Wednesday, the US Non-Farm Payrolls (July) and the final Manufacturing PMI (July) for the US, China and Germany will be released. Thursday will see the release of the US unemployment rate (July) and industrial orders (June). The following week will bring Producer Prices (July) for the Eurozone and China.

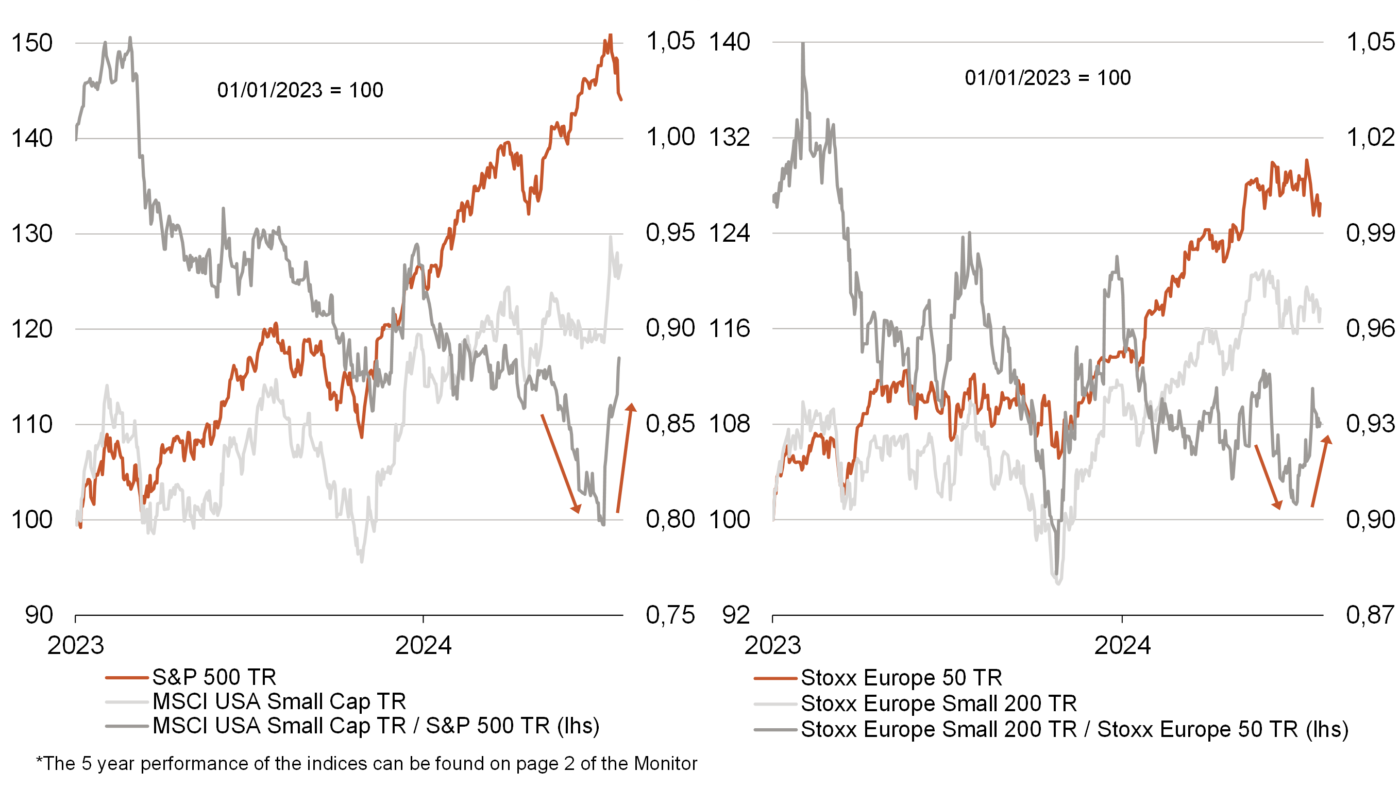

Small cap rotation - a turnaround at last?

- Market breadth has widened significantly over the past two weeks, especially in the US, triggered by the drop in US inflation data for June.

- The recent small-cap rally was driven by falling interest rates, declining optimism towards mega-caps, private investors and short covering.

- However, technical factors are unlikely to play a major role going forward. The Q2 reporting season and, in the longer term, an economic recovery are likely to be key drivers of market breadth.