Current market commentary

Concerns about the enormous US government debt and more stubborn inflation caused 10-year US interest rates to rise by more than 15 basis points at their peak last week, before disappointing results from Salesforce and fears of a slowdown in US growth caused bond yields to fall again. There was profit-taking in equities and commodities. Following the strong performance of many risk asset classes, we consider the consolidation to be healthy. We continue to expect a volatile sideways movement in equities until the US elections. On the one hand, there have recently been positive earnings revisions and favourable macro surprises in Europe and China. The Atlanta Fed's real GDP growth estimate for Q2 is 2.7%. On the other hand, valuations have risen recently and many investors have already overweighted equities. In addition, the conviction of Donald Trump in the hush money trial shows that the political risks should not be underestimated.

Short-term outlook

The next two weeks are all about elections. The European elections take place from 6 to 9 June. Elections in Ireland take place on 7 June, parliamentary elections in Bulgaria on 9 June and Belgian elections on 10 June. The G7 summit in Apulia will take place from 13 to 15 June and will focus on the defence of Ukraine, the conflict between Israel and Hamas, economic and energy security and migration policy. On the monetary policy front, the ECB and Fed rate decisions on 6th and 12th June will be interesting. Today we have PMIs (May) in the US and the Eurozone and tomorrow US industrial orders (Apr.) and the change in unemployment (May) in Germany. This will be followed on Wednesday by changes in ADP non-farm payrolls (May). Thursday sees the US trade balance (Apr.) and Friday the important US labour market figures (May). Inflation data (May) for the US and the eurozone (May) will follow next week.

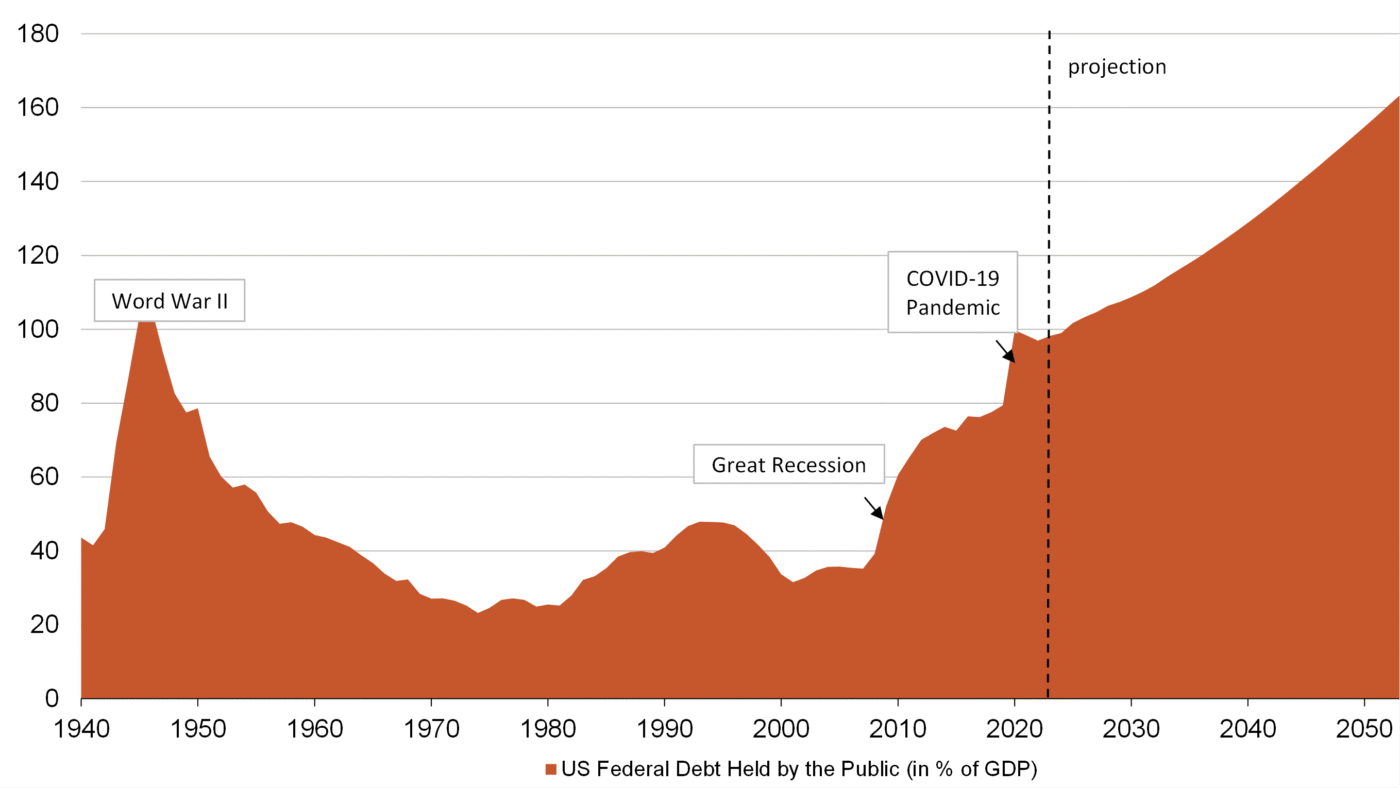

Rising US government debt should put pressure on interest rates

- The US national debt held by the public currently stands at 100% of GDP. The Congressional Budget Office estimates that this debt will rise to over 160% in the next 30 years due to higher interest costs and the undisciplined US fiscal policy.

- It therefore seems unlikely that interest rates on long-term US government bonds will fall in the medium term. The Treasury's high issuing activity to finance the large budget deficit is already exerting pressure on interest rates.