Current market commentary

Western stock markets closed the month of April in the red. The S&P 500 Index lost more than 4% and recorded its first negative month after five positive months. US inflation recently proved more stubborn, expected Fed interest rate cuts were postponed, bond yields rose and the 10-year US real yield climbed to over 2.2%. This is weighing on the equity markets despite a good reporting season, which brought stabilization and the first upward revisions to earnings forecasts for 2024 and 2025. The economic environment appears fundamentally positive for risk assets. However, the markets had already priced in very favorable economic and earnings prospects at the end of March. The consolidation has not yet led to an adjustment of the high positions in rule-based strategies, geopolitical risks are high, the summer is often weaker and the US presidential election campaign is heating up. We expect a volatile sideways movement until the US elections. Tactically, anti-cyclical trading is the obvious choice.

Short-term outlook

The Q1 reporting season is in full swing: of the S&P 500 companies that have reported so far (approx. 80%), almost 77% have beaten earnings expectations. The BoE's interest rate decision is due on May 9, followed by the early Spanish primary elections in Catalonia on May 12. In addition, the Eurogroup and the ECOFIN Council will meet on 13 and 14 May. Today, the Purchasing Managers' Index for the service sector (Apr.) will be published in Germany. Initial jobless claims (Apr.) in the USA will follow on Thursday. In the following week, the consumer price index and the ZEW economic expectations (Apr.) in Germany are on the agenda on Tuesday. This will be followed on Wednesday by retail sales (Apr.) and the consumer price index (Apr.) in the USA. Finally, the GDP (Q1) in Japan will be published on Thursday and the consumer price index (Apr.) in Europe on Friday.

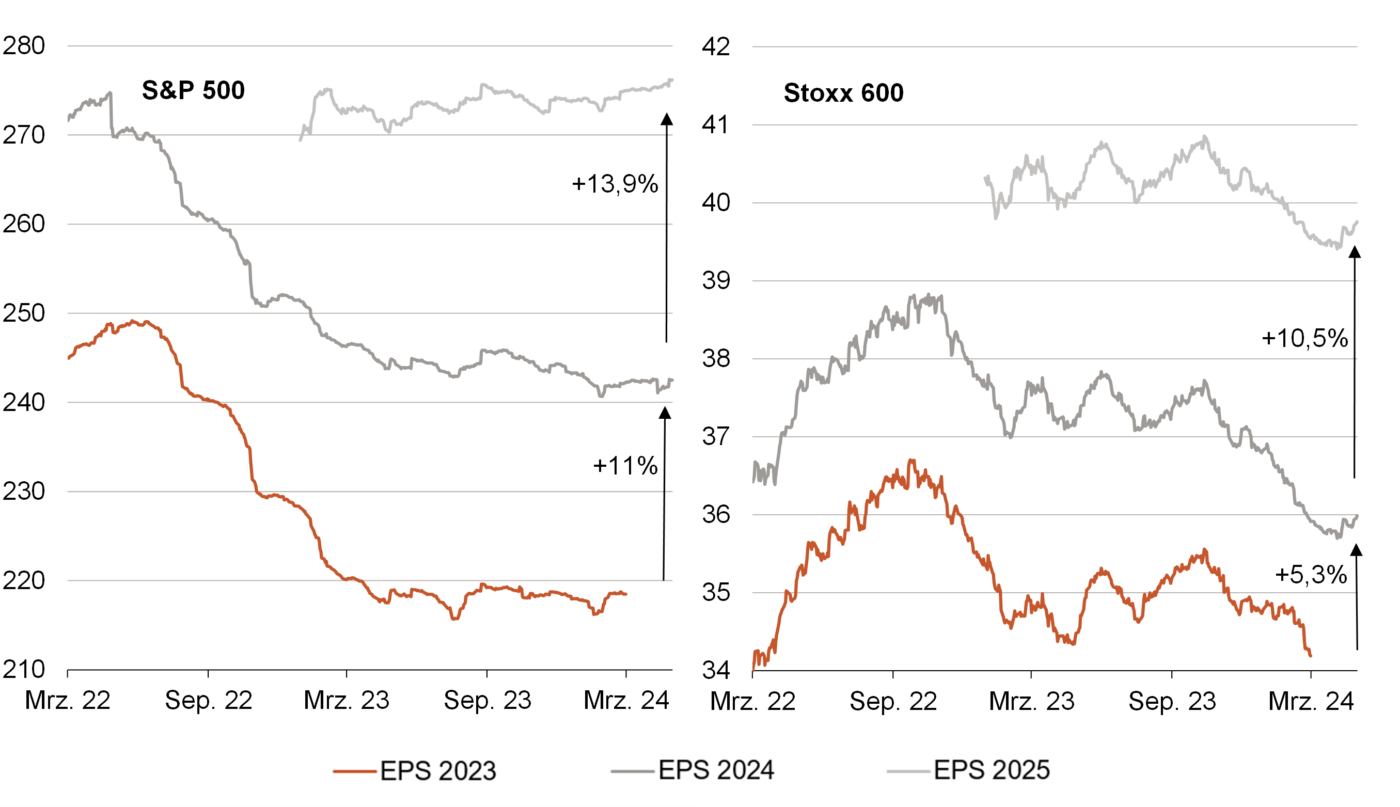

Reporting season stabilises earnings expectations in both US and Europe

- The reporting season for the first quar- ter is going well on both sides of the Atlantic. On average, expectations are being exceeded and the outlook is good.

- As a result, consensus earnings expectations for 2024 and 2025 have not only stabilized, but are beginning to rise. The economic recovery in Europe and the robust growth in the USA are increas- ingly reflected in profit expectations. This is positive.

- The gap between expected EPS growth in the USA and Europe has narrowed recently.