Current market commentary

Donald Trump has recently seen a significant increase in the polls in the swing states and is now considered the favourite for the office of US President. The betting markets even price in a 60 per cent probability of victory for Trump. Accordingly, the ‘Trump trades’ have recently gained. US banks, also supported by strong Q3 reports, US small caps, the US dollar and Bitcoin have all risen significantly. It is widely expected that smaller companies in particular, whose business is limited to the US market, should benefit from Trump's programme of deregulation and protectionism. By contrast, other equity regions such as Europe and China have recently lagged relatively behind. Gold prices reached a new all-time high despite a stronger US dollar and rising interest rates, supported by positive price momentum, central bank purchases, ETF inflows and growing concerns that national debt will continue to rise regardless of the outcome of the US elections.

Short-term outlook

The Q3 reporting season is in full swing. In the next two weeks alone, 58.2% of S&P 500 companies will report. On the political front, the meetings of the IMF and the World Bank on 21 and 26 October, as well as the summits of the BRICS countries from 22-24 October and the Asia-Pacific Economic Cooperation (APEC) from 1-7 November, will be exciting.

This week, the focus is on the preliminary purchasing managers' indices for the service and manufacturing sectors (Oct.) for Germany, the UK and the eurozone on Thursday. On Friday, the University of Michigan's Consumer Confidence Index (Oct.) will be followed by the preliminary US orders for durable goods (Sep.) and the ifo Business Climate for Germany. Next week, the purchasing managers' data for the USA and China (Oct.), US GDP (Q3), US labour market data for the non-agricultural sector (Oct.) and inflation data (Oct.).

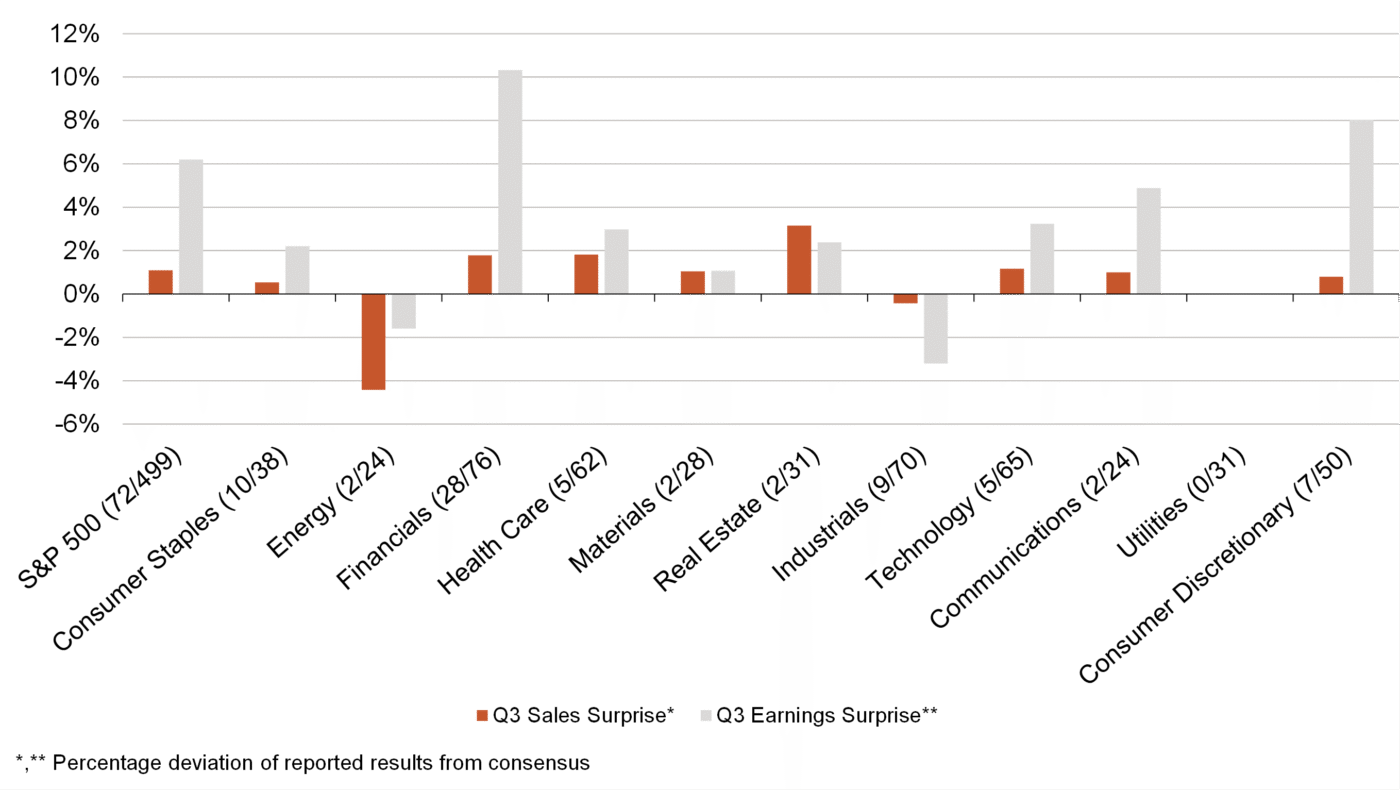

Positive start to the Q3 reporting season in the US

• The US reporting season kicked off with the banks about two weeks ago. They surprised on the upside, particularly on the earnings side. The trend was boosted by increased investment banking activity and higher-than-expected net interest income.

• So far, 72 (15%) of the S&P 500 companies have reported and have mostly surprised positively. For the rest of the reporting season, there is a good chance that the recently reduced earnings expectations will be exceeded – thanks in part to the robust US economy.