Current market commentary

As we feared, market hopes for a quick Fed turnaround once again proved premature. Powell made it clear at last week's Fed meeting that although the pace of rate hikes is likely to slow, this does not equate to a pause and thus a "Fed pivot" (reversal of monetary policy). Accordingly, interest rates are likely to remain elevated for longer. This weighed on interest-sensitive asset classes, such as the Nasdaq, while commodity-related investments held up well – also because there have recently been increasing rumours that China could reverse its zero-covid policy in the spring of next year. The reversal from the strict zero-covid policy could accordingly come before the Fed pivot. We remain constructive on commodities not only tactically but also structurally. In our view, a sustained recovery of equity markets requires continued weaker economic and inflation data. Only then do we consider a real Fed pivot as likely.

Short-term outlook

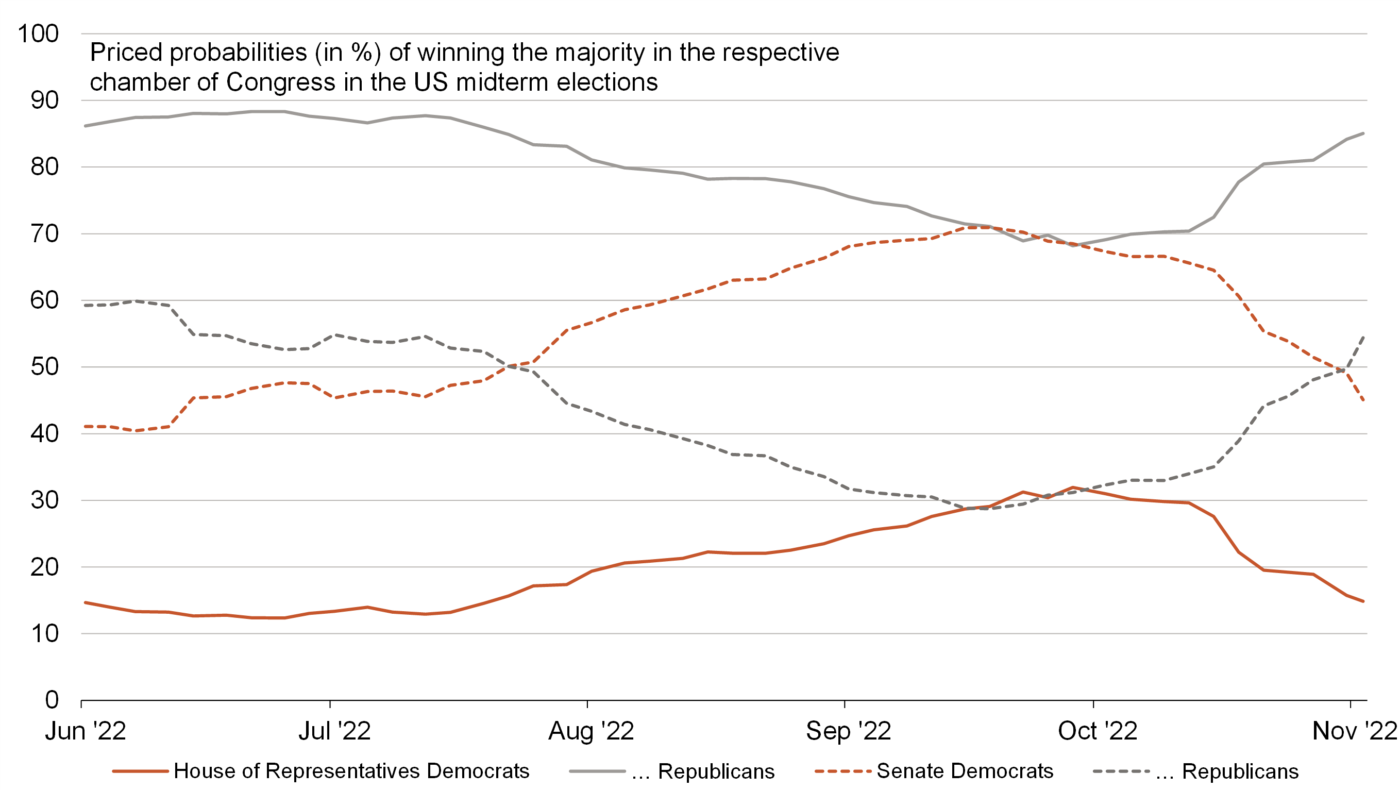

The next two weeks will be political. On 8 November, the mid-term elections will be held in the US. Currently, the Republicans are leading in the polls in both the House and the Senate. If this were to happen, US President Biden's ability to govern would be more limited. From 15 to 16 November, the heads of government will meet for the G20 summit in Bali. Putin's war as well as the relationship with China are likely to be central topics.

This week, inflation data (Oct.) for China will be released on Wednesday and for the US on Thursday. This will be followed on Friday by preliminary Q3 GDP data for the UK and US consumer confidence (Uni Michigan, Nov.). In the following week, the ZEW economic expectations (Nov.) for Germany as well as retail sales (Oct.), industrial production data (Oct.), the Empire State and Leading Index (Nov.) as well as the producer price index (Oct.) for the US will be announced.

"Gridlock" in US policy ahead – often positive for equity markets

- The US mid-term elections are due tomorrow. Betting markets are currently predicting that the Republicans will win a majority in both the House of Repre- sentatives and the Senate. This means that Biden will hardly be able to push through domestic policy decisions. Such a "gridlock" is often positive for markets.

- However, some Republicans are already threatening to only raise the debt ceiling early next year if Biden agrees to spend-ing cuts. In 2011, this had temporarily led to distortions on markets.