Current market commentary

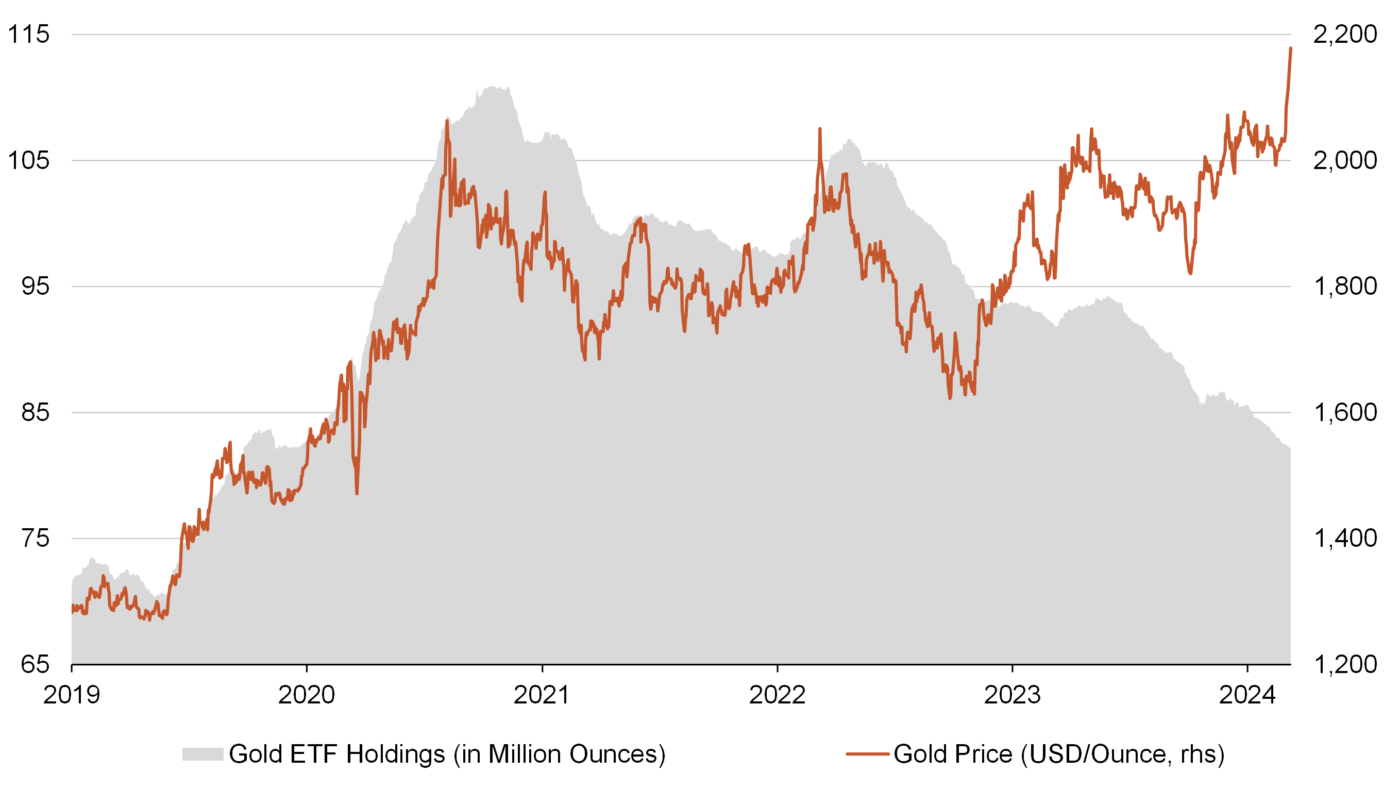

More and more market participants are being pushed into the equity markets. Recently, risk parity strategies in particular have been adding to equities due to the decline in equity and bond volatility and the lower correlation between the two asset classes. In addition, share buyback programmes have now picked up speed again following the end of the reporting season. At the same time, analysts have revised their earnings estimates for this year slightly upwards in view of the robust economic data and solid reporting season. The fundamental picture has therefore brightened, although the optimism is already reflected in investor sentiment, positioning and equity valuations. The situation is different for gold, which reached a new all-time high last week. Many investors have missed out on the bull market, and global gold ETFs have even seen outflows in recent months. And if the central banks cut interest rates soon, this should not be particularly negative for gold either.

Short-term outlook

The next two weeks will be exciting in both monetary and geopolitical terms. The presidential elections in Russia will take place on 17 March. The Fed and the BoE will then meet on 20 and 21 March. No interest rate changes are expected in either case. The European Council meets on 23 and 24 March. Inflation data (Feb.) for the US and Germany will be published this Tuesday. Industrial production data (Jan.) for the eurozone are due on Wednesday. This will be followed on Thursday by initial jobless claims (Mar. 9), producer prices (Feb.) and retail sales (Feb.) for the US. The week will be concluded with industrial production (Feb.), the Empire State Index (Mar.) and consumer confidence (Mar.) for the US. In the following week, the agenda for the US includes the housing market data (Feb.), the preliminary purchasing managers' index (Mar.) and the preliminary consumer confidence from the University of Michigan, and in Germany the ZEW and ifo survey results (Mar.).

Gold at all-time high without a clear trigger and despite ETF outflows

- Gold has recently climbed to new alltime highs, although there was no trigger from the typical drivers such as central bank policy, economic development or geopolitics. The breakout therefore appears to be primarily technical in nature.

- However, ETF investors have sold over 3 million ounces since the beginning of the year.

- Thanks to the clean positioning and the structurally higher demand from central banks and Chinese savers, gold does not seem to be particularly overpriced despite the recent movement.