Current market commentary

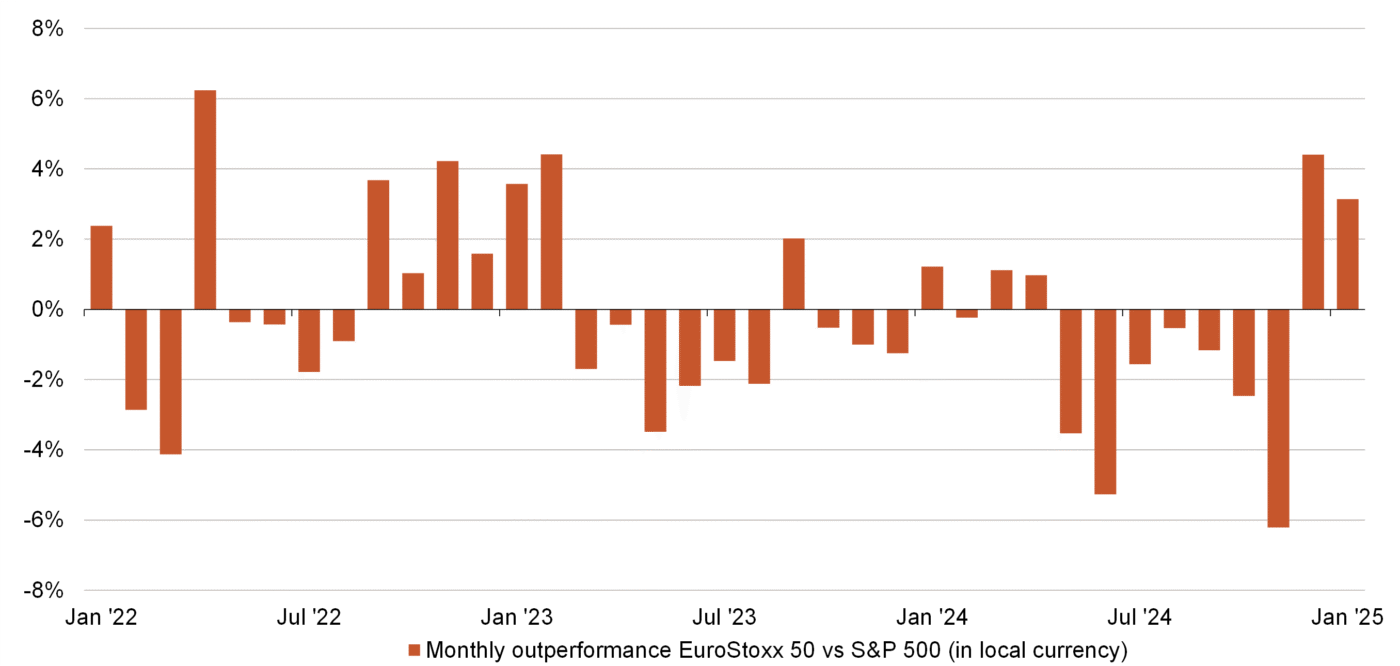

Hardly anyone thought it possible, but European shares have outperformed, at least temporarily. The Euro Stoxx 50 has risen by a good 7 % since the beginning of December, while the S&P 500 has fallen by just under 1 %. The one-sided positioning in US equities following the US elections is likely to have been the main reason for this. The consensus was very optimistic for the USA (deregulation, tax cuts) and very sceptical for the rest of the world (tariffs). However, the election promises must first be implemented. For Europe, on the other hand, there are numerous opportunities for positive surprises (Chinese stimulus, peace in Ukraine, fewer tariffs than expected, reforms). Finally, interest rates in the US have recently risen more sharply than in Europe and the US dollar has appreciated. This has improved Europe's relative competitiveness. How long the outperformance lasts is likely to depend on Donald Trump's next steps. On a P/E basis, however, there is still a lot of negativity priced in for Europe.

Short-term outlook

The next two weeks will be politically exciting. Donald Trump's inauguration is scheduled for today in the US. The World Economic Forum will also take place in Davos from 20-24 January. On the (monetary) policy front, the Fed will hold its first meeting of the year on 29 January and the ECB on 30 January. In addition to political events, the Q4 reporting season is also upon us. Around 32 % of the S&P 500 companies will report in the next two weeks.

On the economic front, the German ZEW index (Jan.) is due out on Tuesday. This will be followed on Friday by the preliminary manufacturing and services PMIs (Jan.) for Germany, the US, the UK and the Eurozone. Next week's agenda includes Preliminary GDP (Q4) for the US, the Euro-Zone and Germany, Retail Sales (Dec.) and CPI (Jan.) for Germany, as well as Core Consumer Spending (Dec.) for the US.

European equities are back – at least temporarily

- Europe is back. After seven consecutive months of underperformance, the longest period since 2020, the Euro Stoxx 50 outperformed the S&P 500 by 4.4% in December. The start to the year also appears to have been more than successful, with an excess return of 3.2%.

- The strong US economy, together with higher interest rates and a stronger dollar, ultimately weighed on highly valued US equities. Cheaper European equities, on the other hand, benefited from more favourable financing conditions and the weak euro.