Current market commentary

There were more negative economic surprises in the US last week, such as retail sales. It remains to be seen whether this is just a blip or the start of something more serious. In any case, the weaker US data and the fact that inflation figures are no longer so hot have taken some of the pressure off the Fed to be hawkish. The market is increasingly pricing in a "Goldilocks" regime of solid nominal growth, declining inflation and moderate rate cuts. As a result, many equity indices in the US and Europe have reached new all-time highs. Commodities such as gold and copper also hit new highs. Market breadth has recently increased significantly, allowing even previously unpopular small caps to post decent gains. Investor sentiment is correspondingly positive. Positioning analyses are already pointing to a risk-averse, if not yet extreme, allocation for many investor groups.

Short-term outlook

The Q1 reporting season is drawing to a close. Around 93% of S&P 500 companies have already reported. Over the next two weeks, the focus will be on technology and consumer companies. The inauguration of Taiwanese President Lai Ching-te takes place today. However, the inauguration is not expected to lead to a significant escalation of tensions between China and Taiwan. This is followed by the South African elections on 29 May and the OPEC+ meeting on 1 June.

On Wednesday, investors will focus on the minutes of the latest Fed meeting. On Thursday, the focus will be on the preliminary European PMIs for May. This is followed on Friday by German GDP figures (Q1), as well as US preliminary durable goods orders (April) and the University of Michigan's final consumer confidence figures (May). The following week will see the release of US GDP (Q1) and European inflation figures (May).

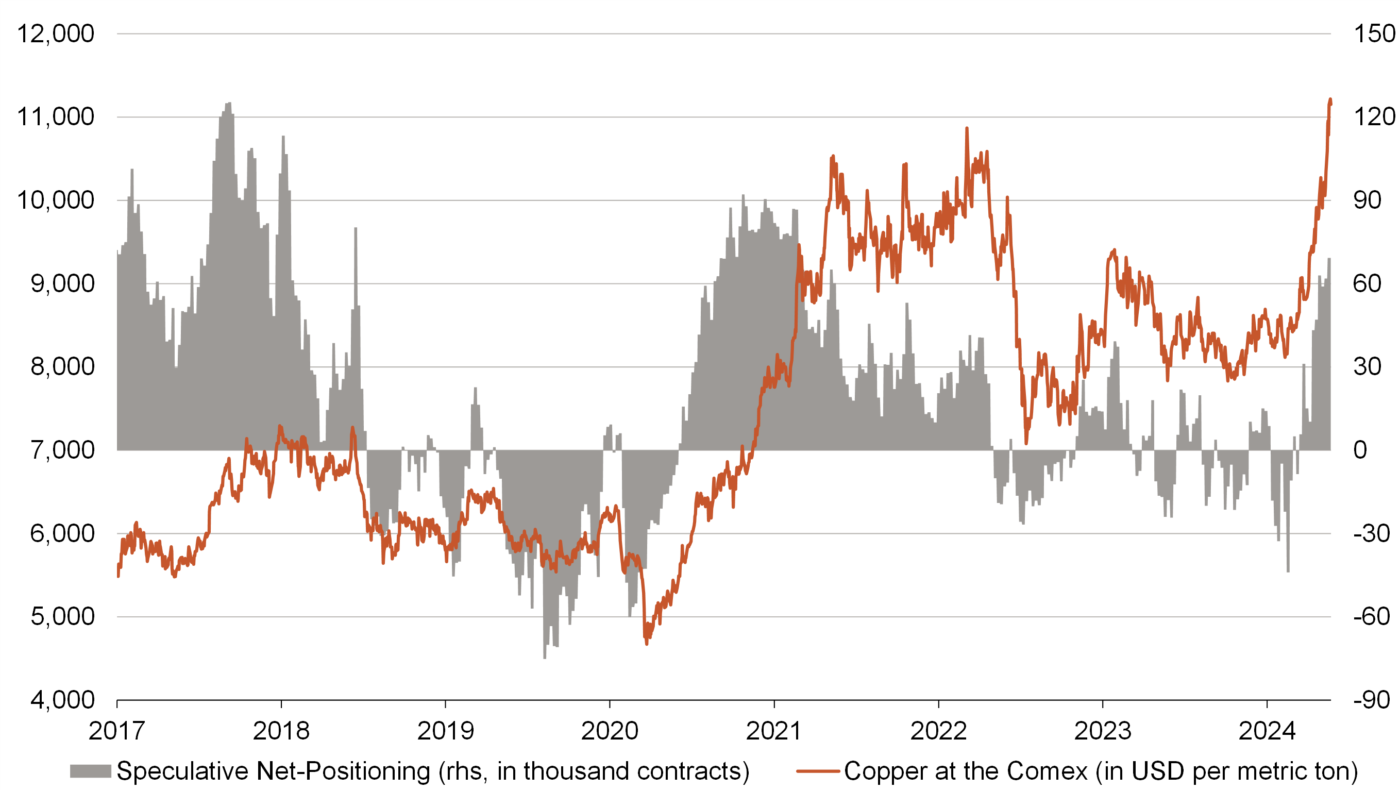

Copper at all-time high with fundamental and speculative tailwinds

- The copper price on the US metal exchange has risen by more than 25% this year and reached a new all-time high.

- Fundamentally, there are a lot of positives: activity in the manufacturing sector in the West appears to have bottomed out, demand growth in China

remains robust, inventories have fallen significantly and supply continues to grow only slowly. - However, the recent rally was not only driven by fundamentals, but also by speculation. A consolidation therefore seems likely in the short term.