Current market commentary

The Chinese stimulus measures and the Fed's sharp interest rate cut support our positive medium-term outlook for the capital markets. Especially since both the Fed and the ECB are ready and willing to cut interest rates further. Liquidity is likely to increase globally in Q4 (China stimulus + interest rate cuts by central banks) and a recession is not on the horizon, at least not in the next few months – on the contrary, we expect the loose financial conditions of recent months to lead to positive economic surprises in Q4, similar to what we experienced in Q1 of this year. In the short term, however, geopolitical risks and the US elections are likely to cause increased volatility. We are therefore maintaining our balanced positioning with a slight overweighting of risky assets (equities, commodities and high-yield bonds). In bonds, we are avoiding duration risks, particularly in the US, as we believe that the interest rate cuts that have been priced in – apart from a recession – are too high.

Short-term outlook

The Q3 reporting season begins this week with the first business figures from US companies on Friday. Over the next two weeks, around 11% of the companies in the S&P 500, based on market capitalisation, will report. At the index level, earnings are expected to grow by 4.6% and sales by 4.8% year-on-year in the third quarter. On the (monetary) policy front, the first summit between the EU and the Gulf Cooperation Council will take place in Brussels on 16 October, followed by the next ECB interest rate meeting on 17 October.

On Tuesday, German industrial production data (Aug.) will be released, followed on Thursday by Italian industrial production (Aug.), US inflation data (Sep.) and weekly US initial jobless claims. On Friday, the UK's monthly GDP (Aug.) and US producer price inflation (Sep.) will be announced.

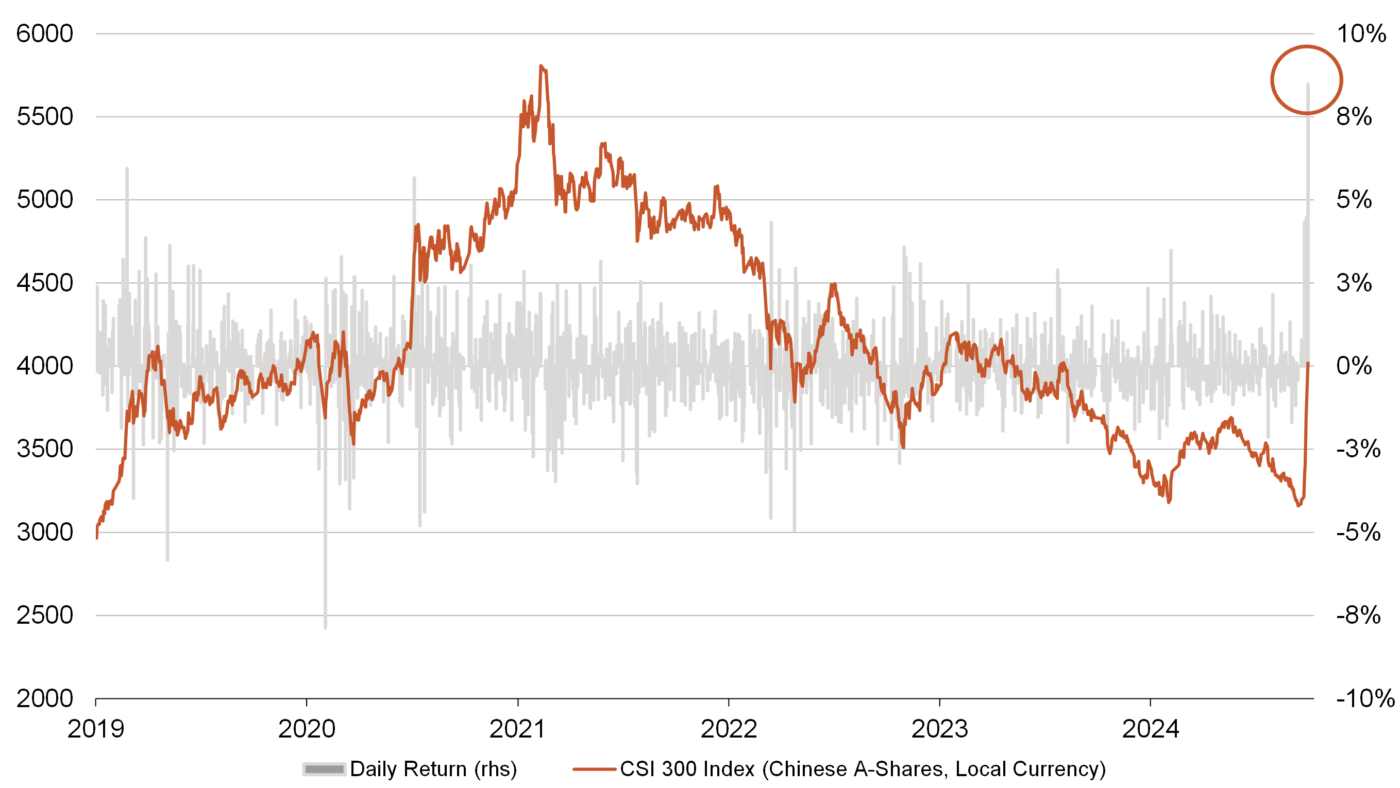

Chinese ‘Whatever it takes’ moment? Rally in Chinese equities

- At the end of September, China intervened more strongly than it has done for a long time due to the ongoing weak growth. In addition to providing a large liquidity injection into the stock market, the PBoC cut its key rates more sharply than expected and relaxed all conditions for the property market. Fiscal stimulus was also promised.

- The CSI 300 Chinese stock index then recorded its largest single-day gain since 2008 and, in just one week, became the best performing stock market since the beginning of the year.