Current market commentary

In 2021, global government bonds posted a loss, if one disregards currency effects, while global equities made significant gains. 2021 is thus only the fourth year (1999, 2005, 2013, 2021) in the last half century with losses in bonds and gains in equities. This rare combination could repeat itself this year. In any case, we expect rising bond yields and thus falling bond prices in the sovereign segment due to tighter monetary policy on the part of central banks and falling but persistent inflation. We are cautiously optimistic about equities. The lack of alternatives and rising corporate profits should provide support, but valuations are likely to decline, especially in the US, so we see moderate upside potential. In any case, 2022 is likely to be more challenging than 2021.

Short-term outlook

2022 has some exciting political events in store. In France, a new president will be elected in April and in the US, Joe Biden's accomplishments since he took office will be put to the test in the mid-term elections in November. The first Fed rate hike could come as early as Q1. The next two weeks will be comparatively quiet. However, various economic data will be released, which should provide first insights into the economic impact of the omicron variant. Today, the manufacturing PMIs (Dec.) for the Eurozone as well as Spain and Italy will be released. On Wednesday, the respective data for the services sector will follow. On Thursday, the inflation figures (Dec.) as well as the new factory orders (Nov.) for Germany and the ISM Services (Dec.) for the US will be published. This will be followed on Friday by industrial production (Nov.) for Germany and France and labour market data (Dec.) for the US.

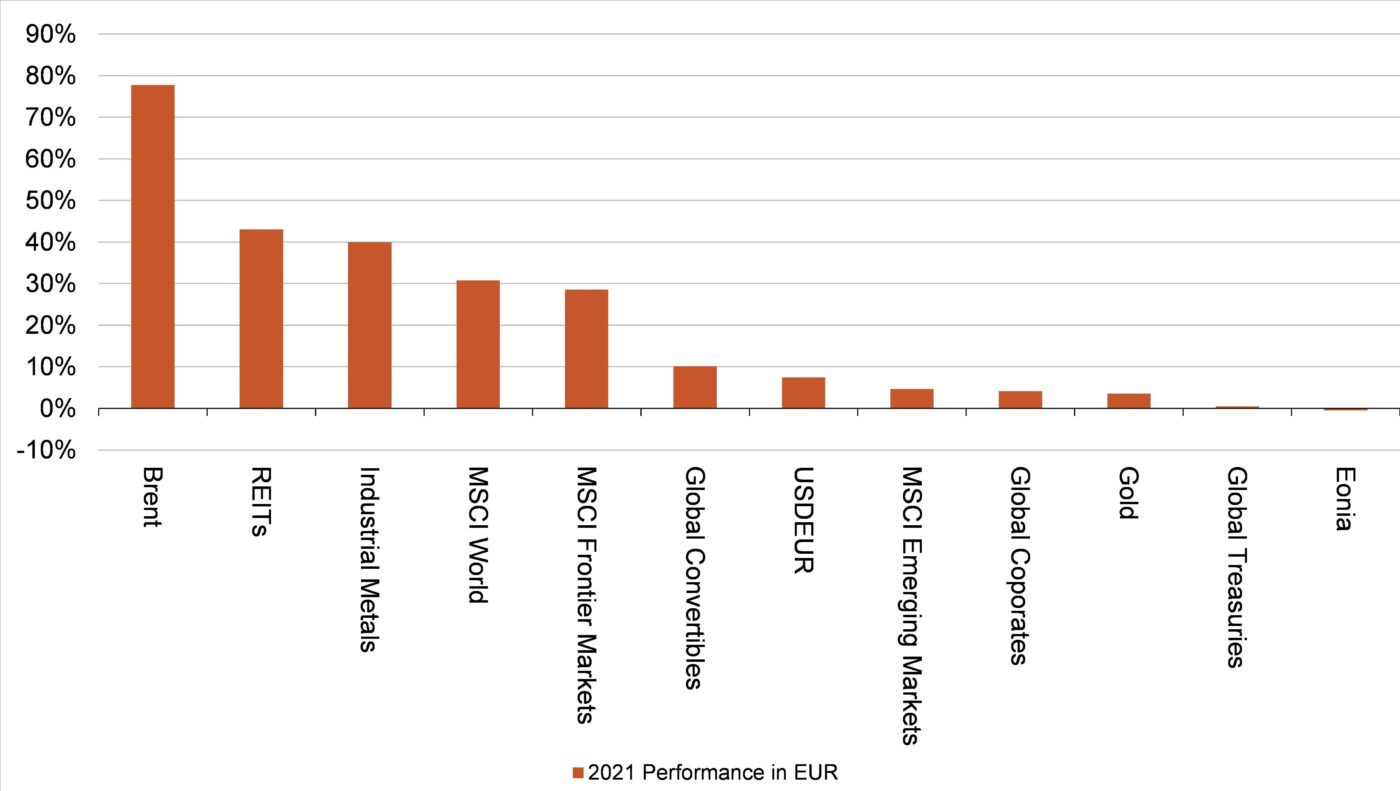

2021 positive for most asset classes (in EUR terms)

- On the surface, 2021 was a very positive year for investors in the euro area. The US dollar appreciated by about 7% against the euro, thus even global gov-ernment bonds did not post losses in EUR terms.

- Energy and industrial metals were the big winners in 2021, along with developed market equities and REITs.

- Relative losers included gold and EM equities, which were mainly weighed down by the weak performance of Chinese equities.