Focus on central banks and the economy

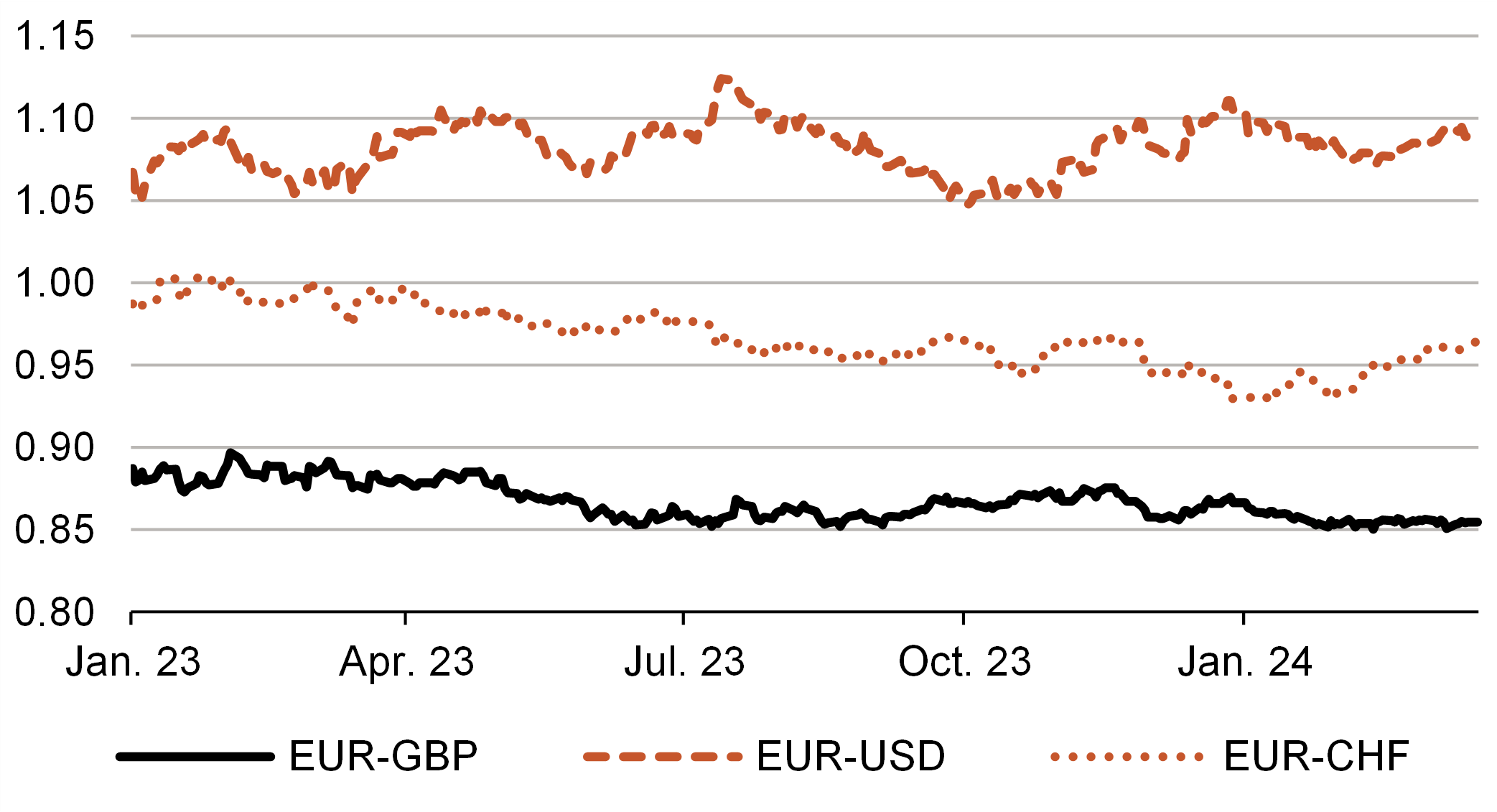

The euro has recently regained some ground. Since mid-February, the currency has appreciated moderately against the strong dollar, recently reaching a rate of USD1.09 per euro – close to the level of USD1.10 that we expect by mid-year. Whether the euro area economy recovers as expected, and when and by how much interest rates will fall, will be important for future developments.

The dollar has already been strong for several years

Nominal effective exchange rates

After the latest policy meeting on 7 March, ECB President Christine Lagarde signalled very clearly that the bank intends to wait until June before possibly cutting interest rates. We expect the ECB, the US Federal Reserve and the Bank of England to begin their rate cuts later in the second quarter, close to each other. The exact sequence of the first rate cuts could cause short-term volatility in the currency markets. In the long run, however, it should be insignificant.

Over the medium term, US key rates are likely to be about one percentage point higher than in the eurozone. However, given the higher starting level, we expect the Fed to cut rates more than the ECB over the next twelve months – by 150 basis points versus 100 basis points.

The euro has recently regained some ground

Euro exchange rates

The US economy has been more dynamic than other economies in recent years, which has also helped the dollar. If, as we expect, the eurozone is able to emerge from its spring stagnation, there is some upside potential for the euro. It could rise slightly to USD1.12 by the end of the year. However, this would not be a real high for the euro. If nothing intervenes, it could rise further towards USD1.15 by the end of 2025 (and USD1.20 by the end of 2026).

The euro also gained some ground against the Swiss franc in February. Although the current exchange rate of 0.96 euros per franc is still very low by historical standards, we expect little further upside potential for the time being. Low inflation in Switzerland mitigates the competitive disadvantage of the strong franc for Swiss companies.

We also do not expect any major changes in the exchange rate of the euro against sterling. The economic trend is similar to that in the eurozone.

Exchange rate forecasts

Berenberg and consensus forecast in comparison, values at the end of 2024 and mid-2025

Author