In a nutshell

The economic environment, increasing corporate takeovers and a reallocation of investor funds from short-term interest-rate investments suggest that the bull market will continue.

The numerous political risks, the high valuations of (US) equities and the low credit risk premiums on corporate bonds are limiting the return potential of risky investments. More setbacks and higher volatility are to be expected. Government bonds offer little potential.

After the start of the year, at the latest with the swearing-in of Donald Trump on 20 January, things are likely to get tougher.

The trend towards more market breadth from the second half of 2024 should continue in 2025 and support small cap stocks.

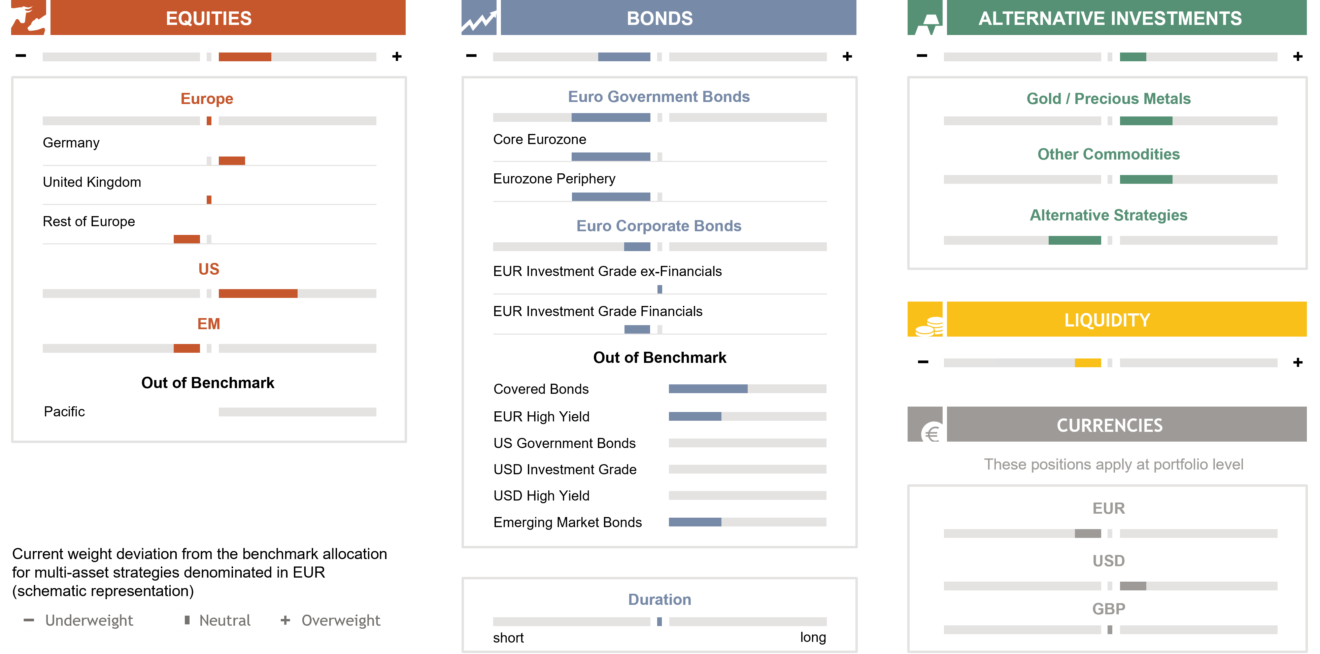

Portfolio positioning at a glance

In view of the uncertainty surrounding the US election outcome, we started the fourth quarter with a balanced positioning. An overweight in bonds or long duration was also not on the cards, as we considered the market’s expectations of interest rate cuts to be exaggerated. With the increasing probability of a Trump victory, we built up our equity holdings further ahead of the election, particularly US mid caps, partly at the expense of Europe. We took a further step immediately after Trump’s victory. As we enter the new year, we are sticking to our overweighting of (US) equities and commodities over bonds and cash, but expect markets to become more volatile again, at the latest from when Donald Trump is sworn in. Government bonds offer little potential in 2025 – unless there is an economic downturn or an escalation of geopolitical risks. Corporate bonds offer more attractive yields, but risk premiums are fair at best. We see opportunities in local currency bonds from emerging markets and in high-yield bonds. Gold has performed very well, but remains significantly overweighted. Other commodities, particularly industrial metals, remain a sensible portfolio addition due to their tangible value and are supported by structural trends.

Berenberg Asset Allocation

Fourth-quarter review: Trump and positive economic signals

Economic surprises in the US, the eurozone and China turned positive as early as the beginning of October. The market’s high expectations of interest rate cuts were subsequently corrected, and bond yields rose. Gold continued to rise, supported by steady inflows. Otherwise, as expected, much of the focus was on the US elections. The likelihood of a Trump victory increased during October and, following his landslide victory, left its mark on the markets. The US dollar and US equities, in particular small caps, rose significantly. Rising yields weighed on government bonds, while equities from the rest of the world stagnated. Corporate bonds, especially high-yield bonds, continued to be the top performers among bonds, and both oil and industrial metals rose significantly.

Positive economic outlook – but with a multitude of risks

Falling central bank interest rates worldwide, disinflation and further fiscal stimulus in the US and China should support the economy in 2025. Economists largely agree that the global economy will grow at a similarly strong rate in 2025 as in 2024. The consensus view is that the US economy will lose momentum due to cooling domestic demand and labour market conditions, while Europe is positioned for a slight recovery.

2024 – better than expected; 2025 – US weaker, Europe stronger

Real GDP growth expectations (economists consensus) for 2024 and 2025 a year ago and currently

Our economists paint a similar picture. Compared to a year ago, the risk of a hard landing of the US economy has decreased significantly. The existing Fed put, ie the possibility that the Fed could cut interest rates even further in an emergency, has recently been supplemented by a Trump put. Both support the prevailing market optimism. In addition to US politics, the development of inflation and the US national debt are likely to be among the most important topics in 2025 and are subject to a high degree of uncertainty. With regard to US inflation, deregulation, lower energy prices, a stronger US dollar and the release of labour in the public sector could counteract the inflationary effect of tariffs and lower immigration. Here it is a matter of waiting and observing the situation, especially since Trump’s starting position is much more difficult than in 2016, when the economy was close to deflation, equities were moderately valued, corporate profit margins were low, the tax burden was high and the budget deficit was low. In 2024, the economy is strong, the deficit is around 7% of GDP, profit margins are high, the tax burden is lower and US equity valuations are close to all-time highs. Trump’s policies at this time – tariffs, tax cuts and immigration restrictions – are likely to have less of an impact today and entail greater risks. The future interest rate path and Fed policy are therefore subject to a high degree of uncertainty. This is likely to lead to higher volatility in the financial markets. A sharp rise in bond yields poses a major risk for highly valued (US) equities and corporate bonds, especially if inflation were to pick up again and the Fed were forced to tighten in the second half of the year – as it did in 2018.

Potential returns are likely to be more limited in 2025

The positive economic outlook, an increase in corporate takeovers and a possible reallocation of investor funds from short-term interest-rate investments suggest a continuation of the stock bull market that has been ongoing since October 2022. Historically, bull markets last an average of six years. However, a repeat of the very good performance and low volatility of the last two years seems unlikely. The consensus forecast for US earnings growth in 2025 is in the double-digit percentage range, despite a decline in nominal growth and already record-high profit margins. A lot of optimism is already priced in and investor positioning is already pronounced, so the upside potential for US equities in particular appears more limited than it has been recently. Historically, the third year of a bull market in the US has tended to be weak, with the S&P 500 returning just 6%. For European equities, risks and risk premia are high, making performance highly dependent on the macroeconomic and political environment. Bonds are likely to produce only moderate gains, while gold should remain supported by increased uncertainty and central bank purchases.

US dollar and US equities benefited from Trump's victory in Q4, while European and EM equities suffered, along with government bonds.

2025: Support through reallocation from money market funds

In 2024, investors again “parked” a lot of money in short-term interest rate investments such as money market funds or time deposits. Even though they increasingly turned to equities and bonds, money market funds continued to have the highest inflows both in absolute terms and relative to their total assets. Over the last 12 months, holdings in US money market funds have risen by USD900bn to USD6.8trn. So far, this strategy has not paid off for investors – over the last 12 months, all other asset classes have outperformed. With the interest rate cuts, reinvestment is now becoming increasingly unattractive. As the economy strengthens, investors are likely to turn to other investments. In the past, money market funds have experienced outflows about 6-12 months after the first rate cuts.

Money market fund outflows start about 12 months after rate cuts

6M changes in money market fund holdings (%) compared with the Fed funds rate

More demanding markets at the latest after Trump’s swearing-in

Stocks should remain supported into the new year, not least due to positive seasonality. However, the implementation of Trump’s policies could result in at least temporary pressures. In addition, markets have developed certain expectations of an easing of the geopolitical situation, which could be disappointed. The recent deterioration in financial conditions in the US (stronger US dollar, higher bond yields) could become a headwind for the US economy, and US economic surprises in the first quarter could turn negative again.

A stock market rally without setbacks seems unlikely in 2025

After a new US president takes office, there is often a breather in the stock markets.