In a nutshell

The recovery in equities and bonds since the end of October is an interest rate-driven valuation expansion and is unlikely to be the start of a more sustained market upturn.

A phase of weaker growth still lies ahead of a possible economic upturn. The omnipresent scenario of a soft landing for the US economy is largely priced in and harbours numerous risks.

With clearly positive real yields and in view of more growth than inflation risks, interest rate duration is more attractive again. In the event of weak growth, a negative correlation of stocks and government bonds is likely to return (temporarily).

Portfolio positioning at a glance

We started the fourth quarter with a defensive positioning. When the stock markets corrected by more than 10% from the end of July to the end of October, we reduced our equity underweighting from moderate to only small and at the same time increased our bond position and its interest rate duration in view of the high bond yields. However, we are now not chasing the subsequent strong recovery in equities and bonds. The market is already largely pricing in the strong consensus for 2024, despite the numerous risks to the scenario. We are, therefore, maintaining a broad positioning, with overweights in bonds and alternative investments such as gold, industrial metals and a position that would benefit from a steeper US yield curve. In the case of corporate bonds, we are focusing on short maturities, as risk premiums are likely to widen again in the event of economic weakness. In the case of safer bonds (government bonds, mortgage bonds), we are focusing on longer maturities. Emerging market bonds in local currency also remain attractive. Our focus on quality and growth stocks should benefit in the event of a weaker economy and without a further rise in interest rates. In view of the upturn expected later in the year, small caps and cyclical commodities, which are now very attractively valued, are also interesting.

Berenberg Asset Allocation

Fourth quarter: US economic weakness brings recovery

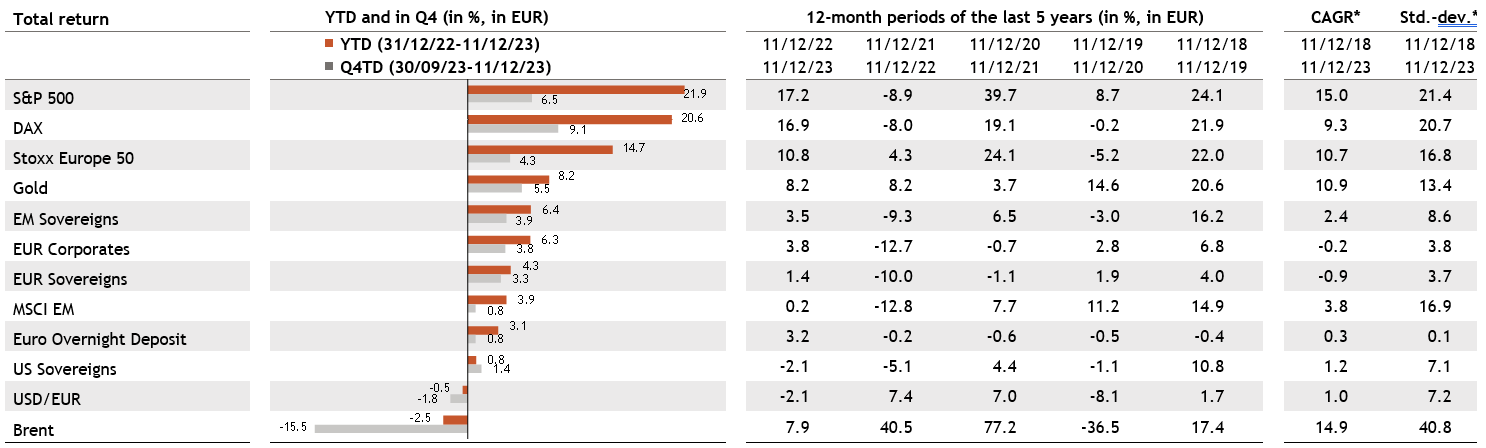

The trends of the third quarter continued in October. The US economy continued to be surprisingly robust and yields continued to climb with higher issue volumes of US government bonds – the real yield on 10-year inflation-indexed US government bonds reached 2.5%. Bonds and equities suffered at the same time. At the end of October, global and US equities had corrected by more than 10% from their highs at the end of July. US economic data then weakened and US inflation surprised to the downside. Further rate hikes were then completely priced out and expectations of interest rate cuts increased. Bond yields fell significantly, with the 10-year US real yield dropping below 2.0%. Equities and bonds recovered significantly from their lows. The US dollar weakened and gold, additionally supported by the outbreak of the Israel-Hamas conflict, rose significantly. The oil price fell despite the conflict.

2024: From weakness to recovery, with obstacles

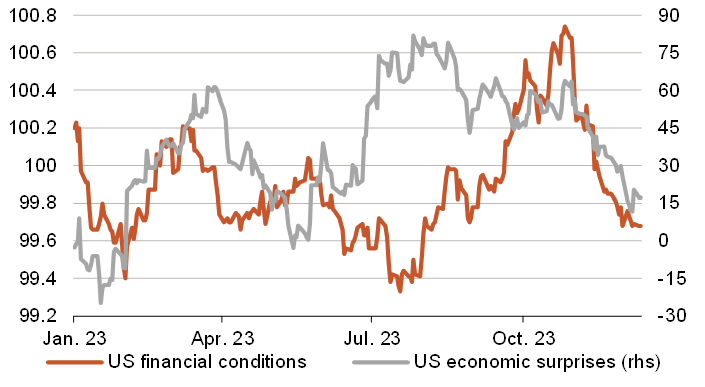

For 2024, our economists expect a soft landing for the US economy in winter and then an upturn in the course of 2024. In Europe, too, the economy is likely to remain weak until spring. Inflation is likely to continue to fall slowly amid weak growth, and interest rates have probably peaked. The Fed is likely to cut interest rates from the spring, while the European Central bank (ECB) will keep money market rates stable for the time being. However, this scenario harbours many risks. The recent strong improvement in financial conditions (top chart, p. 5) could further delay the US economy's landing and revive the narrative of prolonged high interest rates. Alternatively, the wave of high (re-)financing costs is yet to hit companies, private households, and governments. This could make the landing less soft after all. But even if there is a soft landing, we do not expect the markets to price this in consistently, but that there will be renewed turbulence. In addition, geopolitical risks remain high on the agenda and the US presidential election is just one of many important elections in what the Economist describes as the biggest election year in history.Normalised real yields offer a good starting position

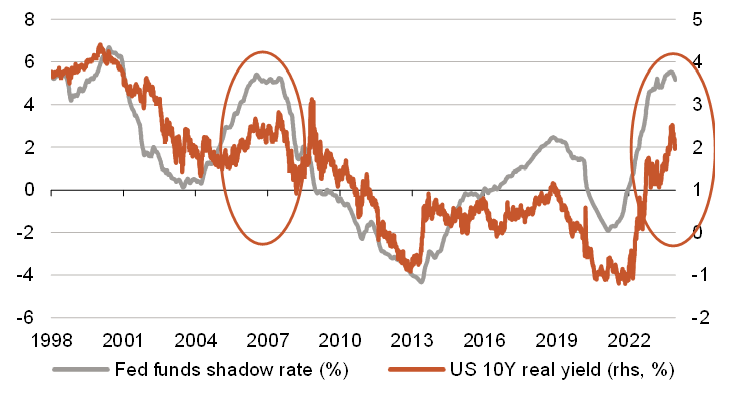

The rise in bond yields is the biggest change for investors in recent years. Due to the tightening of monetary policy, this was driven exclusively by rising real yields. The rise of a further half percentage point has prevented 2023 from being an even better year for investors (middle chart, p. 5). Real yields are now at the same level as before the financial market crisis and offer a good starting point for investors (bottom chart, p. 5). This applies not only to bonds, which offer high current yields and the chance of declining yields as price drivers, but also to equities, especially rate-sensitive segments, which have suffered greatly from the rise in interest rates. A further sharp rise is unlikely. However, without a recession and a strong easing of monetary policy, investors should not hope for a sharp fall in real yields either, as these are countered by the piling wave of refinancing in the US and its high level of new debt. A rapid increase in valuations due to a sharp fall in real yields is not to be expected. Investors should therefore pay particular attention to (structural) earnings growth and attractive valuations.

Q4 with reversal of Q3: gold, equities and bonds rose, the US dollar and oil fell. Many asset classes positive since the start of the year.

Equities or bonds, who will win the race in 2024?

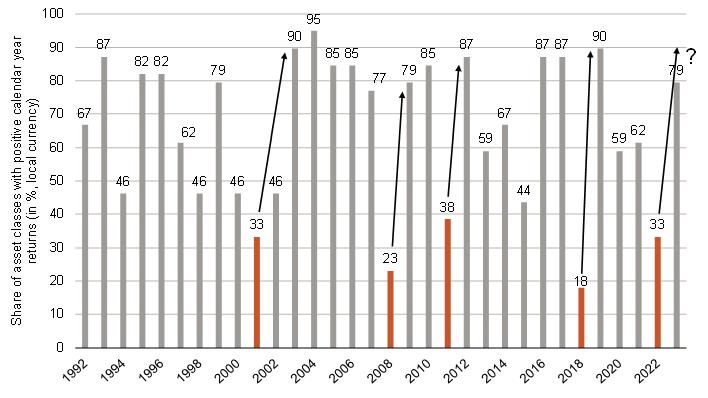

There is little consensus as to whether equities will beat bonds in 2024 or vice versa. According to a survey by Bank of America, a clear majority of fund managers expect bonds to beat equities. However, the strategists of the major banks differ greatly on this issue, despite comparable expectations for the economy and monetary policy. This is the result of the fact that both equities and bonds are "only" expected to generate single-digit returns. A strong increase in valuations seems unlikely and earnings growth expectations in the market appear too high. This means that the nuances of the macro and interest rate picture will decide who should win the race. Our base scenario favours moderately positive return potential for all asset classes in 2024, i.e. equities, bonds, commodities and cash. Bonds could be ahead in the first few months and equities later in the year. In 2024, a large proportion of all asset classes would then generate positive returns (middle chart). In the alternative scenarios, it would only be individual asset classes. A broad, balanced positioning therefore makes sense now in particular. If, for example, there are signs of a less soft landing for the US economy, bonds are likely to perform significantly better initially. If, on the other hand, the Fed loosens the monetary reins without a recession, the US dollar is likely to weaken and risky investments, particularly small caps and emerging market exposure, are likely to rise more significantly. If growth remains robust and the issue of prolonged high or even higher interest rates returns, larger companies with strong balance sheets and probably commodities are likely to outperform.

Easing of financial conditions could support the US economy

The recent weakening of the US dollar and oil price, lower bond yields and rising equity markets could give the US economy renewed momentum.

Focus on opportunities beneath the surface of asset classes

Even if a pronounced positioning across the asset classes does not currently appear to make sense, there are attractive segments within the asset classes. After two years of strong underperformance, European small and micro caps offer an attractive absolute and relative valuation despite stronger earnings growth than large caps. They are likely to recover significantly with falling interest rates and the prospect of an economic upturn. Pharma, biotech and medtech have also suffered greatly from rising interest rates and are benefiting from the ageing population. Local currency bonds from emerging and frontier markets offer double-digit running yields and the chance of currency appreciation should the US dollar weaken with a weaker US economy and less restrictive Fed policy. In addition, catastrophe bonds offer double-digit yields and are uncorrelated. Silver and industrial metals are experiencing increased demand due to the energy transition coupled with a lack of supply and would benefit from an economic recovery, particularly in Asia.

2023 was better for multi-asset, despite rise in real interest rates

After the poor year 2022, a larger proportion of all asset classes (segments, regions,...) delivered a positive return in 2023

US real yields only fall more sharply if the Fed eases significantly

The Fed Funds shadow rate reflects the central bank rate and effects of quanti-tative easing/tightening and shows a strong synchronisation with real yields.

Author

Prof. Dr. Bernd Meyer

Prof. Dr. Bernd Meyer has been Chief Investment Strategist at Berenberg Wealth and Asset Management since October 2017, where he is responsible for discretionary multi-asset strategies and wealth management mandates. Prof. Dr. Meyer was initially Head of European Equity Strategy at Deutsche Bank in Frankfurt and London and, from 2010, Head of Global Cross Asset Strategy Research at Commerzbank. In this role Prof. Dr. Meyer has received several awards. In the renowned Extel Survey from 2013 to 2017, he and his team ranked among the top three multi-asset research teams worldwide. Prof. Dr. Meyer is DVFA Investment Analyst, Chartered Financial Analyst (CFA) and guest lecturer for "Empirical Research in Finance" at the University of Trier. He has published numerous articles and two books and received three scientific awards.