Trade wars are good, and easy to win.

Donald Trump, March 2018

- Tariff policies act like a one-time tax on US consumers, with their overall impact depending on the availability of substitute goods and fluctuations in exchange rates relative to trading partners.

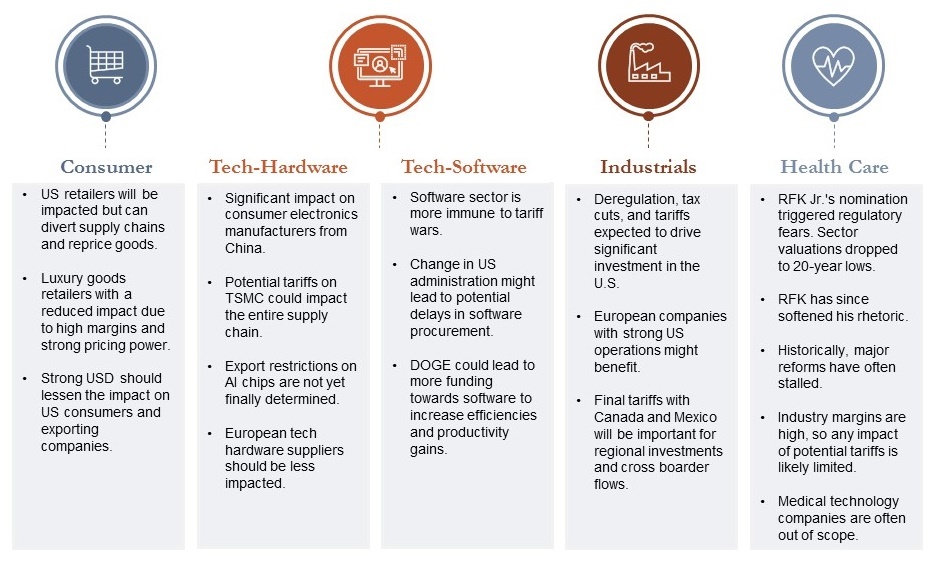

- The sectors most likely to be affected are consumer goods, tech hardware, and industrials.

- We expect only a limited impact on the vast majority of our holdings.

The election in the USA is behind us, and Donald Trump has won. The financial markets had already priced in part of the outcome before the polling stations closed and continued their developments after the final result. However, the beginning of 2025 brought a surprise: European stocks have outperformed the US markets. This was likely due to the one-sided positioning in US stocks following the election. Consensus was highly optimistic about the USA, particularly because of the announced plans for deregulation and tax cuts, and very sceptical about the rest of the world, as US tariffs were expected to have a negative impact. Now, the new US administration must first implement its "election promises."

Trump Trade: Possible implications for our core sectors

Reasons for the relative outperformance of Europe since the beginning of the year

Europe offers numerous opportunities for positive surprises, such as a strong Chinese stimulus, a possible peace in Ukraine, or lowerthan-expected tariffs. Moreover, real interest rates in the USA have recently risen more sharply than in Europe, and the US dollar has appreciated. This has improved Europe’s relative competitiveness. How long this outperformance will last depends on Donald Trump's next steps. News about tariffs and deals will dominate the headlines, and the trade war between the USA and China will remain in focus. The open question is how the "Trump Trade" will evolve after an extremely strong start and a brief pause. Companies with structural growth trends and little dependence on political developments appear very attractive in such a highly political environment.

However, let’s take a deeper look at our core investment sectors and analyse potential impacts to test this hypothesis.

US consumer companies and the potential for price increases

Tariff policies act like a one-time tax on US consumers, with their impact depending on the availability of substitutes and fluctuations in exchange rates relative to trading partners. Despite the potential tariff threats, the US consumer is in a very good state driven by economic optimism due to the Trump presidency as well as a buoyant stock market which has created significant household wealth effects. The strong consumption pattern is very visible by the strong earnings results by payment providers such as Visa, Mastercard and Adyen. Payment volumes in the US are robust and especially travel shows strong results.

US retailers are affected since a significant portion of their merchandise is sourced from abroad, even if supply chains have diversified after the first tariff episode in 2018. Overall, price increases due to tariffs tend to affect all retailers similarly. Still, industries with rational pricing strategies should see less of an impact. The car parts sector has been very successful in passing on cost increases - a boon for a company like AutoZone.

In the e-commerce sector, while repricing should be possible, we anticipate a significant shift in sourcing destinations as well as increased demand elasticity among consumers. Among the companies discussed, we expect that merchants on Amazon and Meta may reduce some of their advertising budgets as a consequence. Nevertheless, given the size and diversity of both businesses, only a limited portion of their revenues is likely to be affected. To conclude, while tariffs will most likely have a negative impact on consumers in general, we think this “one-time tax” will be absorbed as the improved economic outlook and the increased wealth effect will outweigh any potential negatives.

Luxury goods and the “heritage” challenge

While other industries have been able to relocate part of their production to the US since Donald Trump’s first term, this has not been possible to the same extent in the luxury industry. Whether these are Hermès bags or Cartier jewellery proudly produced in France, or luxury watch brands like Vacheron Constantin and Rolex, whose defining characteristic is their Swiss origin, the place of production is not merely a logistical factor—it is a core part of the brand’s identity and appeal. Luxury brands rely on the craftsmanship, heritage, and exclusivity tied to their original manufacturing locations. Therefore, we think that even under potential tariffs, our key luxury holdings - Richemont, Hermès and Moncler - will not significantly alter their manufacturing locations and will thus be subject to potential US tariffs.

However, we are less concerned about the outlook of these companies, as they have historically demonstrated pricing power, successfully implementing price increases without a significant drop in demand. The key to sustaining attractive earnings growth for these brands is maintaining strong brand desirability, as this allows them to implement mid-single-digit price increases without triggering a demand backlash. A secondary effect that we are seeing is that, due to the strong US Dollar, travelling and shopping overseas, particularly in Europe, has been booming, leading to stronger luxury sales in the brands home countries as well.

Tech hardware facing potential impact, but with limited risks for the portfolio

In the context of trade tariffs, we expect the most substantial and immediate impact to be on consumer electronics manufacturers (smartphones, TVs, PCs) that produce in China and Mexico and sell their products in the United States. Companies such as Apple, Lenovo, and Panasonic are likely to be among the most negatively affected.

Among our portfolio holdings, TSMC, the global leader in advanced processor manufacturing, could be impacted if significant trade tariffs (i.e. 100% or higher) are applied to Taiwan, where the majority of its production is located. Such tariffs could make U.S.-based manufacturing more economically viable, potentially prompting TSMC to shift additional production capacity to the United States. The extent to which the company can pass on higher production costs to customers will be a key factor in determining potential margin impact. In the event of tariffs, TSMC has already communicated that it will pass on a significant portion of the costs to its end customers. Given TSMC’s leading position in advanced manufacturing, we do not expect any meaningful shifts in market share.

For our portfolio holdings Marvell and Broadcom, we foresee very limited operational risks, as their growth is primarily driven by the expansion of U.S. data centres. We do not anticipate major repercussions, given the persistent need for increased capacity among cloud providers.

For our tech hardware holdings such as ASML, ASMI and BESI there is limited direct impact from US tariffs. However, since TSMC is by far their largest customer, future pricing discussions could become more challenging. On the other hand, if the US aims to strengthen domestic semiconductor manufacturing, it would be virtually impossible to do so without relying on these three leadingedge hardware suppliers.

Software is more immune to political cross currents

Since tariffs are traditionally aimed at physical goods crossing borders, purely software-based products and services have typically fallen outside the scope of most tariff regimes. However, there are indirect consequences on the cost side, particularly regarding hardware and components, which may become more expensive to import. This is espcially relevant for chips sourced by TSMC from Taiwan, which is the main source for high-end compute. While we must wait for further clarifications, software companies should be able to at least partially pass these costs on to users.

Another aspect of the change in the US administration is a potential delay in software procurement until the new government is formed. ServiceNow hinted during their earnings call that new federal contract wins will likely be weighted toward the second half of the year, whereas SAP has only limited revenues with the US government. Additionally, several US software companies such as ServiceNow and Workday mentioned lately, that DOGE will drive more funding toward the IT-sector in order to accelerate workflow automation and cost savings.

Industrials sector is a mixed bag

The wider industrial sector is clearly a major focus for Trump and his policy going forward. At the World Economic Forum in Davos in January, Trump highlighted his use of tariffs as a tool to boost domestic manufacturing:

By implementing tariffs, we are bringing manufacturing jobs back to the United States, where they belong.

In general manufacturing sites are widespread and over the years companies have tried to produce the products where their customers are located. However, sourcing raw materials and pre-products often relies on Asia and other low-cost regions, potentially leading to higher costs and margin compression. If a company has not strategically reallocated its manufacturing processes, tariffs may reduce profits, as shifting production capacity quickly is challenging.

The management teams of our holdings have identified these risks and took actions accordingly over the last couple of years, hence we do not anticipate massive impacts from tariffs. In some instances, US tariffs could even be a net positive for our European holdings. The reason being that companies like Diploma, a leading cable management company, or Schneider, a power management provider, produce the majority of their products in the US whereas some of their main peers have to import these. This will most likely lead to higher prices for the overall sub-industry allowing the locally producing companies, like the ones mentioned, to harness even higher margins. Looking ahead, we expect companies to prioritise US investments over higher-risk tariff regions such as the EU or Asia. In this scenario US industrial companies with a high exposure to nearshoring and manufacturing expansion will benefit. One of our holdings is a beneficiary of this trend, the Anglo-American company CRH which is one of the largest cement and aggregate producer in the US.

For service-related industrial sectors such as distribution and waste management, we do not foresee significant impacts, as these are primarily local businesses, and product sourcing can be adjusted relatively quickly. A more controversial situation is the transportation sector, particularly in cross-border trade between the U.S. and Mexico or Canada. A prolonged high tariff environment (20%+ tariffs) would likely reduce the flow of goods between these countries.

Healthcare stocks reflect strong political fears

The healthcare sector underperformed thebroader equity markets significantly in the forth quarter of 2024. The main driver that drove the sector to 20-year relative valuation lows was the nomination of Robert F. Kennedy jr. (RFK) as Health and Human Services (HHS) Secretary, which sparked investor concerns about potential adverse US regulations. Prior to his nomination, RFK was very vocal in questioning the safety and efficacy of vaccines. RFK also criticized the influence of pharmaceutical companies on healthcare policies. As a result, investors feared regulatory instability, particularly at agencies such as the U.S. Food and Drug Administration (FDA). However, RFK’s rhetoric has softened since his nomination. During his confirmation hearing, RFK stated that he is not “anti-vaccine” and that he aims to improve transparency in the system. Furthermore, it is worth noting that Trump’s campaign primarily focused on issues such as illegal migration and economic growth, rather than healthcare policy.

From a geopolitical and tariff perspective, we believe the Healthcare sector is well positioned to weather any storm. The sector should be very resilient to any economic damage that might be caused by tariff wars given the non-discretionary nature of demand. In the past, pharmaceutical and medical technology products have been exempted from any tariffs. While pharmaceutical supply chains are complex, procurement in this industry is typically localized. In addition, it is important to highlight that tariffs are typically applied on input cost and not the selling price of products. Given that gross margins in the industry are high, any potential tariff would not have a very meaningful financial impact. When we asked Novo Nordisk about the potential impact of tariffs, management confirmed that tariffs most probably would not have a significant impact on the financial profile of the company. In 2024, Novo Nordisk generated a gross margin close to 85%.

The trend of near-shoring has been ongoing since the pandemic and we would expect this trend to continue under the new US administration. This shift presents opportunities for Western companies such as Lonza, a leading biologics contract development and manufacturing organization with large production sites in the US and Europe. In the medical technology sector, the impact of potential import tariffs must be analysed on a company-specific basis. However, many companies report that they are hardly dependent on imports from China to the U.S. The sector appears to have done its homework in this regard in recent years. Siemens Healthineers also confirmed with its latest financial results that it is hardly affected by tariffs against Mexico or Canada. Similarly, Straumann, for example, has only a small factory in Canada and follows a "China for China" strategy.

Conclusion: expect tariffs to stay but limited impact on our portfolios

The "tariff ghost" is now out of Pandora’s box, as the new US government has made tariffs a key economic tool and strategic priority. We believe that the tariff discussions are there to stay and will even intensify as the year progresses. Recently, the Trump administration announced reciprocal tariffs that are likely to be applied to all trading partners. Hence, countries and companies will be impacted, albeit to varying degrees. Additionally, macroeconomic variables such as exchange rates, product desirability, and the availability of substitutes can mitigate the impact on affected companies.

For our portfolios, we expect only a limited impact on most of our holdings. First, digital, service, financial, and non–US-exposed businesses are unlikely to be affected at all. Secondly, companies with solid pricing power and high gross margins are unlikely to see a significant impact on their earnings. Tariffs are generally applied to import prices, meaning that companies with large markups on their final sales prices are relatively less affected. Conversely, our holdings with significant US exposure might even benefit from some of the tariffs that will be introduced.

Author

Martin Hermann

Martin Hermann has been a Portfolio Manager at Berenberg since October 2017. Before joining Berenberg, he was a Portfolio Manager and Vice President within the award-winning "Europe Equity Growth Team" at Allianz Global Investors. His responsibilities included Deputy Fund Manager for the International Equity Growth Fund. He started his career in 2010 as an Investment Trainee in the Graduate Program at Allianz Global Investors. Martin Hermann holds a Master in Investment Analysis and Corporate Finance from the University of Vienna and is CFA Charterholder.