Investment Strategy

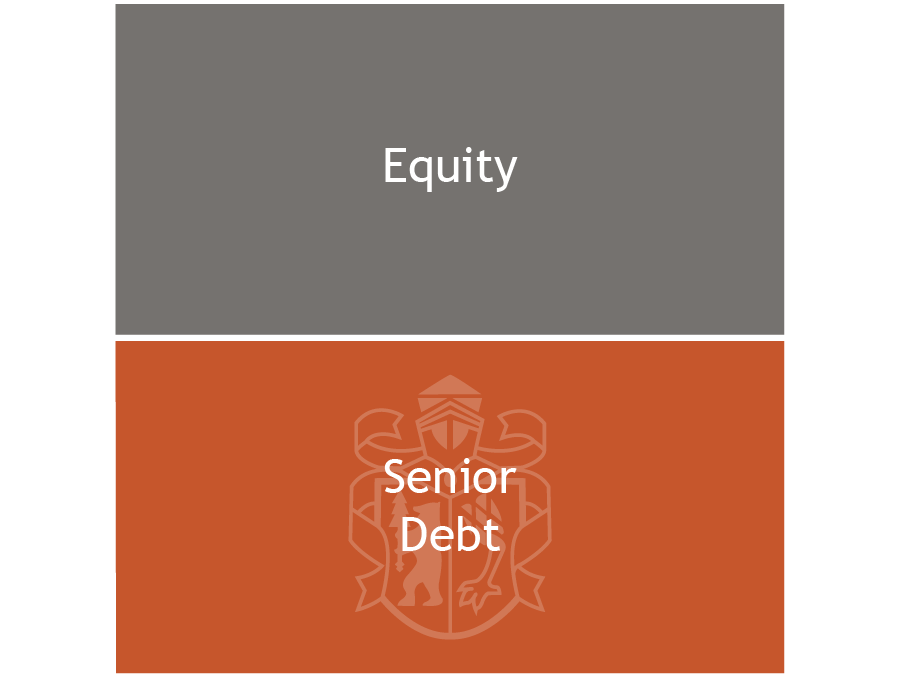

Set up in 2016, the Secured Shipping Debt Funds invest in low-risk first-lien secured shipping mortgage loans and portfolio financings that are conservatively structured and managed by an experienced industry team and that generate consistent returns without losses or impairments since launch.

The focus is on the most common commercial ship types in all liquid segments. Typical loan-to-value ratios are between 40% and 60% of the ship's market value and are thus oriented towards the maximum limit set in the Ship Pfandbrief Act.

Since the 18th century, Berenberg is active in the shipping industry and today the Shipping Team has business relationships with more than 400 international maritime clients. Combined with its long-standing industry expertise, Berenberg ensures constant access to attractive asset-based financing opportunities.

Following the exit of many traditional banks, the capital-intensive sector is particularly suitable for an investment in first-lien secured mortgage-backed financings with an attractive excess return over comparable investments.

Philipp Wünschmann, Head of Shipping

Substantial demand for senior mortgage financings

Today, 80-90% of the global transport of goods is done over the sea without any alternative. Consequently, the ship remains one of the most important instruments of transport of our time. It enables the transport of large cargoes over long distances and hereby a cost-efficient global exchange of goods.

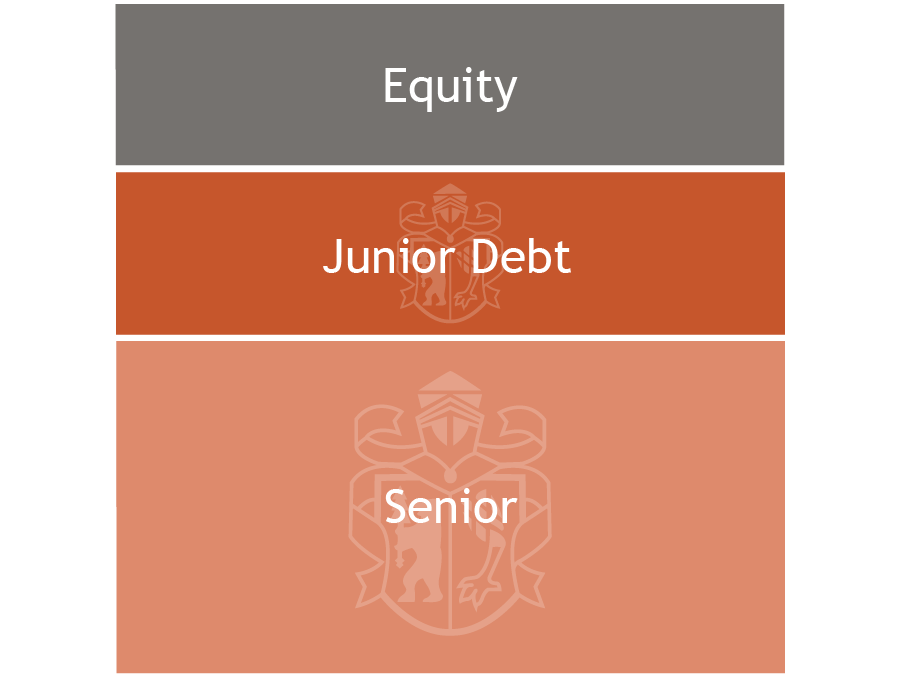

However, the world of ship finance has changed substantially in the last decade. In particular, the traditional European ship-financing banks have almost completely and definitively withdrawn from the market in recent years as a result of the last shipping crisis. With the expectation of risk-adjusted excess returns given the significant financing gap, alternative credit investors, private equity firms and leasing companies have increasingly entered this market in recent years - albeit with a significantly different risk-return profile.

The financing gap for conservative senior debt therefore remains unchanged and enables opportunities for low-risk private debt investments.

Berenberg’s USP

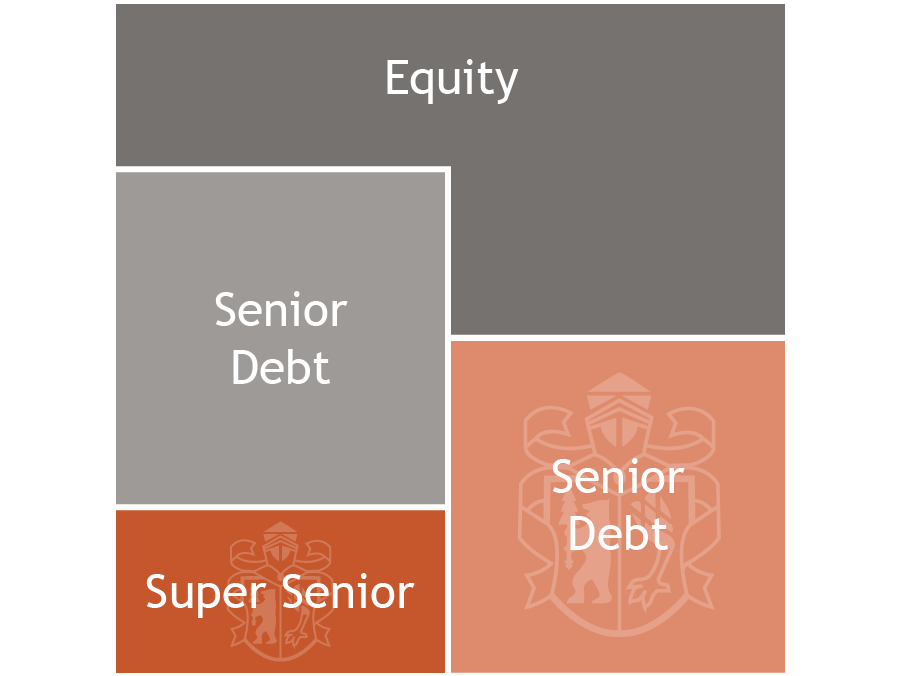

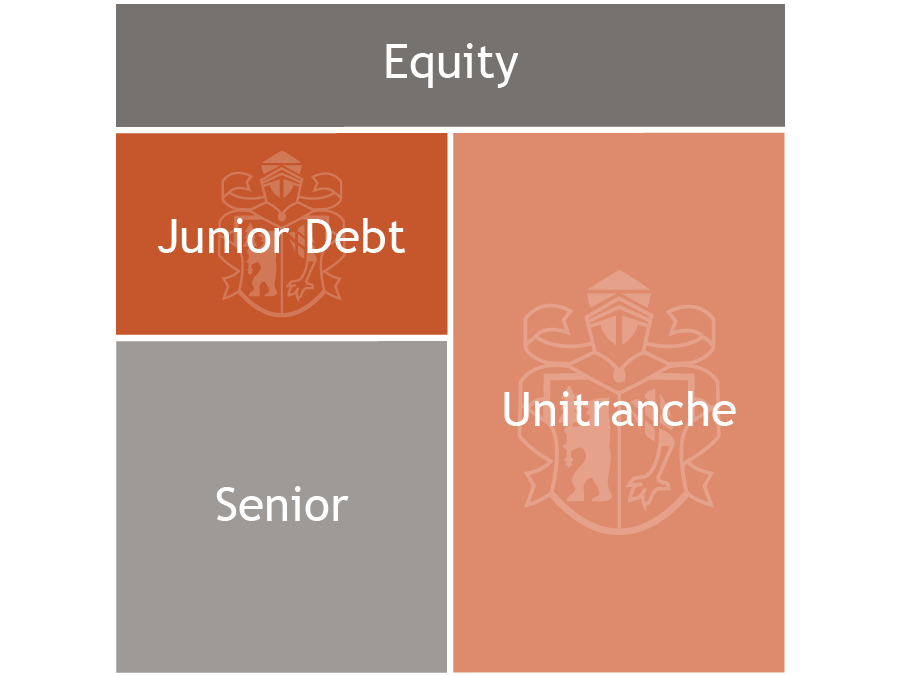

Focus on financing niches by segments, financing ranks and structures

Experienced asset manager with banking licence

Structuring of complex financing solutions

High transaction speed

Broad network and strong industry know-how in various asset classes

Feel free to contact me

In addition to the opportunity for an attractive return, the investment also entails risks which are described in detail in the section "Special Risks" in the issuing document. For example, but not exclusively, the following risks exist:

- Risks from participation in Financings

- Dependence on Berenberg

- Risk from possible conflicts of interest

- Inflation risk

- Interest rate risk

- Investment risk

- Payment obligation arising from financings

- Risk relating to collateral sharing

- Risk of the borrower

- Risk from the general economic situation

- Liquidity risk