Investment Strategy

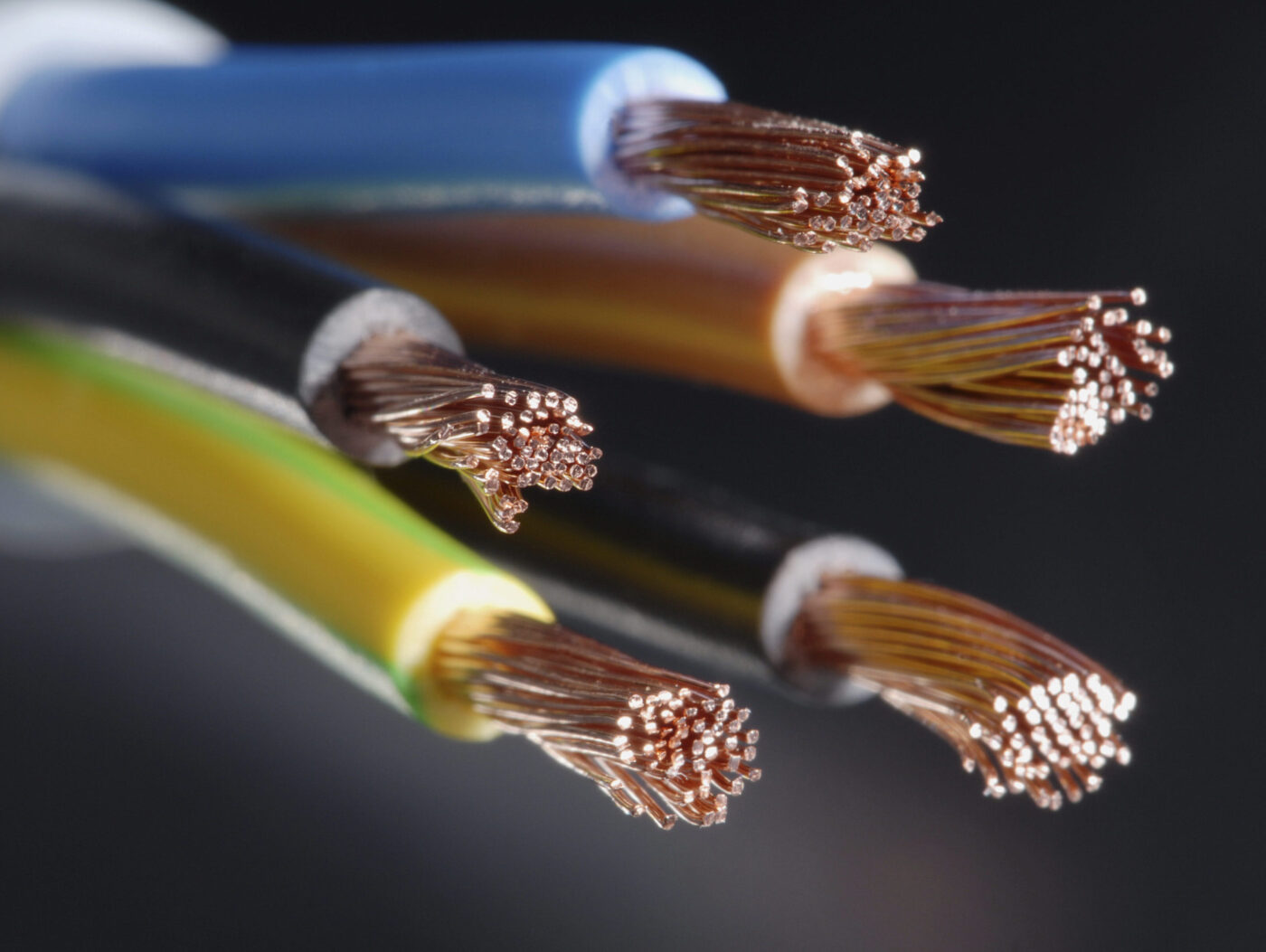

The Digital Infrastructure Debt Fund invests in the attractive asset class of digital infrastructure by way of senior and junior debt financings during the construction and operating phases of projects with a focus on the expansion and operation of fibre-optic networks and data centres as well as mobile communications infrastructure (5G). The financings make an important contribution to the urgently needed modernisation of the infrastructure, which is the basis for an economy to keep pace with the progress of digitalisation.

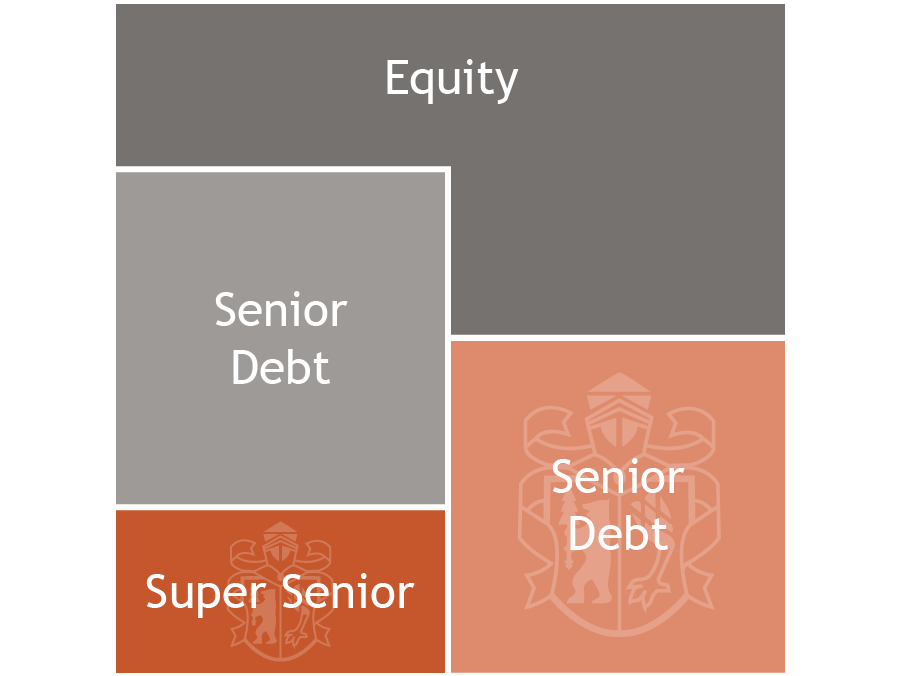

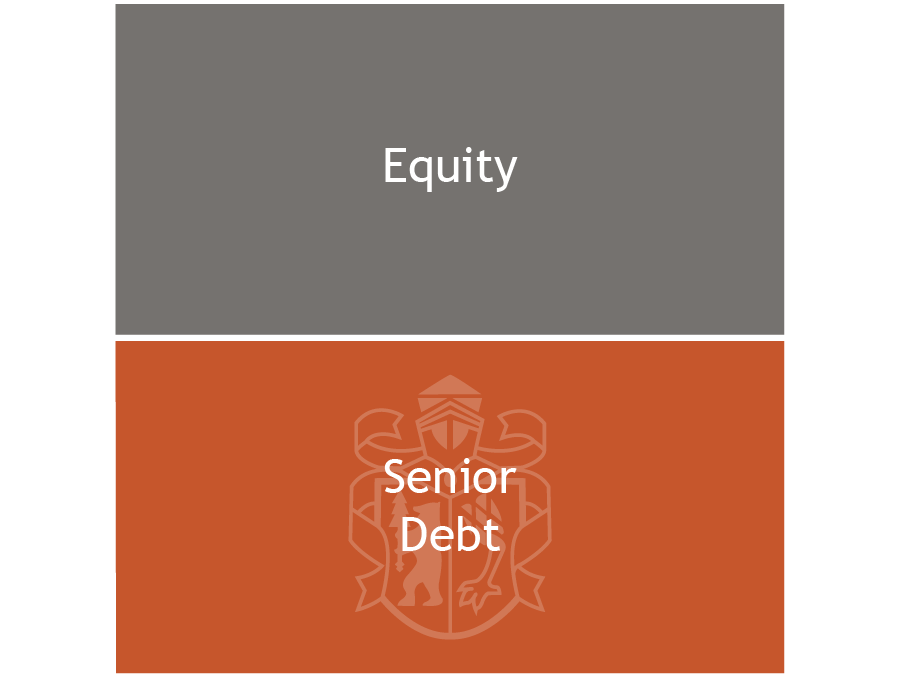

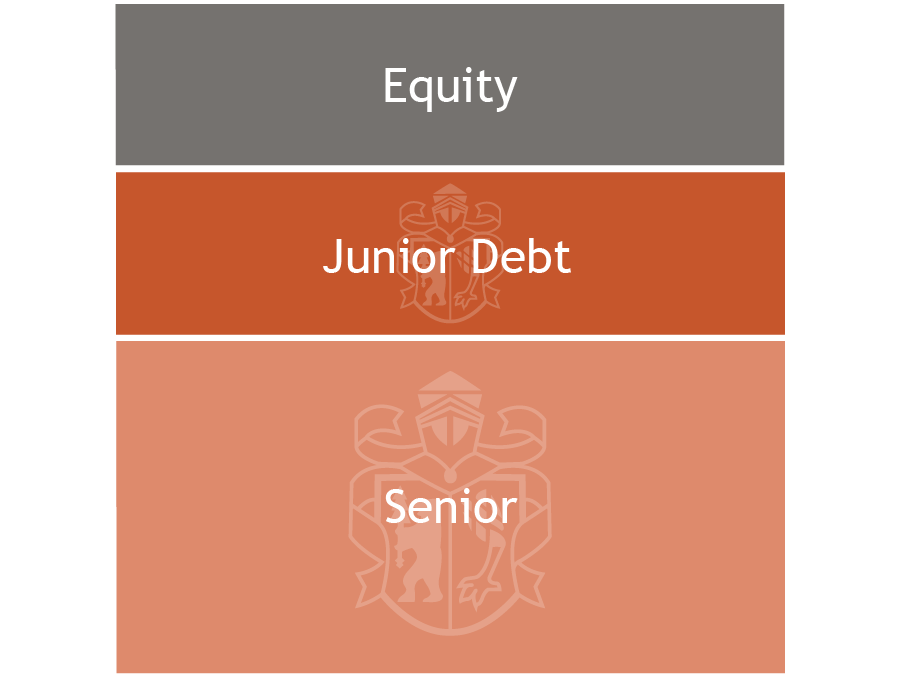

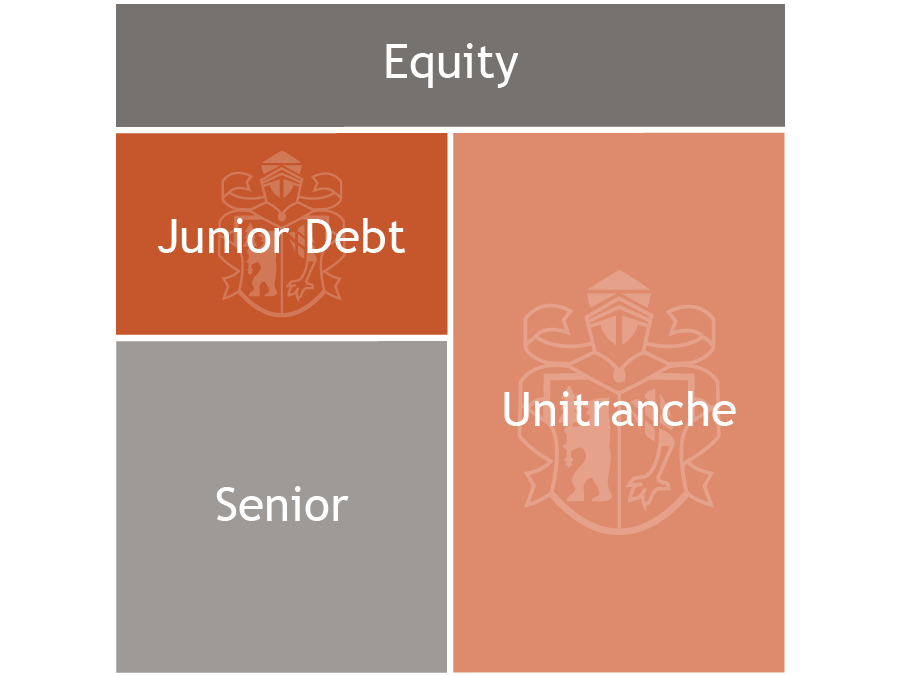

During the construction phase of a project, the fund provides financings in form of secured senior or junior debt. During the operational phase, the fund usually focuses on unitranche or junior debt.

Financing for digital infrastructure projects support the important digitalisation that is essential for a functioning and growing economy.

Torsten Heidemann, Head of Infrastructure & Energy

High need for investment in digital infrastructure

The volume of data transported worldwide continues to rise. Major drivers of growth are megatrends such as the Internet of Things, Industry 4.0, cloud computing, autonomous driving and, as a consequence of the Covid-19 pandemic, there is a much higher number of employees working from home.

In many European countries, the digital infrastructure, especially fibre optic networks and data centres, is still not available in sufficient capacity to handle the projected data volumes and transmission speeds. In addition to the expansion of the fibre-optic infrastructure, investments in data centre capacities are the central building block for the competitiveness of the digital infrastructure worldwide. Another important investment driver within the fibre infrastructure remains the expansion of the 5G infrastructure.

In order to create these required capacities and to compensate the pent-up demand that has become clear in the European area in particular, there is a need for a high level of investments in the digital infrastructure.

Based on the ongoing need for investments in the segments listed above in the short, medium and long term, the Berenberg Digital Infrastructure Debt Fund supports the urgently needed investments through financings in the infrastructure with the aim of enabling a solid basis for the ongoing digitisation.

Berenberg’s USP

Focus on financing niches by segments, financing ranks and structures

Experienced asset manager with banking licence

Structuring of complex financing solutions

High transaction speed

Broad network and strong industry know-how in various asset classes

Feel free to contact me

In addition to the opportunity for an attractive return, the investment also entails risks which are described in detail in the section "Special Risks" in the issuing document. For example, but not exclusively, the following risks exist:

- Risks from participation in Financings

- Dependence on Berenberg

- Risk from possible conflicts of interest

- Inflation risk

- Interest rate risk

- Investment risk

- Payment obligation arising from financings

- Risk relating to collateral sharing

- Risk of the borrower

- Risk from the general economic situation

- Liquidity risk